Is Emerson Electric Stock Underperforming the Nasdaq?

/Emerson%20Electric%20Co_%20sign%20on%20building-by%20SNEHIT%20PHOTO%20via%20Shutterstock.jpg)

With a market cap of $68.4 billion, Emerson Electric Co. (EMR) is a global technology and engineering company headquartered in St. Louis, Missouri. Founded in 1890, Emerson has evolved from a regional manufacturer of electric motors and fans into a diversified industrial leader, providing automation solutions and commercial and residential products to various industries worldwide.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Emerson Electric fits this criterion perfectly. The company boasts strong competitive advantages through its diversified portfolio, global footprint, and leadership in industrial automation and process control. With two core business segments, Automation Solutions and Commercial & Residential Solutions, Emerson serves a wide range of industries, enhancing resilience and revenue stability. Its renowned brands, such as Rosemount and Branson, strengthen its reputation for quality and innovation.

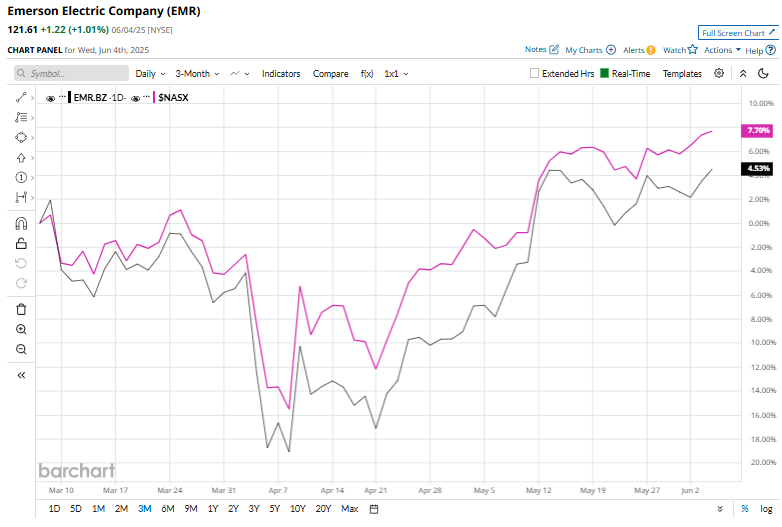

However, the stock has retreated 9.8% from its 52-week high of $134.85 touched on Dec. 4. Shares of EMR have surged 6.7% over the past three months, outperforming the broader Nasdaq Composite’s ($NASX) 6.4% rise over the same time frame.

However, in the longer term, EMR stock is down 1.9% on a YTD basis, lagging behind $NASX’s marginal rally. Moreover, shares of Emerson Electric have risen 13.8% over the past 52 weeks, trailing $NASX’s 15.4% returns over the same time frame.

Yet, EMR has been trading above its 50-day and 200-day moving averages since early May, indicating an uptrend.

On May 7, EMR released its second-quarter earnings, and its shares climbed 2.4%. The company achieved net sales of $4.43 billion, marking a 1% increase year over year, with underlying sales up 2% and underlying orders growing by 4%. Adjusted EPS rose 9% to $1.48, surpassing analyst expectations of $1.41.

The Software and Control segment led growth with a 7% year-over-year increase in sales, driven by a 10% rise in Control Systems & Software. Following the completion of the AspenTech acquisition in March, Emerson updated its fiscal 2025 outlook. The company now anticipates net sales growth of approximately 4% and has raised its adjusted EPS guidance to a range of $5.90 to $6.05. Emerson also plans to return around $2.3 billion to shareholders through dividends and share repurchases.

Moreover, Emerson Electric has lagged behind its competitor Parker-Hannifin Corporation (PH), which has posted a 29.8% gain over the past 52 weeks and is up 4.6% in 2025.

However, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of “Moderate Buy” from the 24 analysts covering the stock, and the mean price target of $135 implies a premium of 11% from the current market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.