How Is Kinder Morgan's Stock Performance Compared to Other Energy Stocks?

Houston, Texas-based Kinder Morgan, Inc. (KMI) operates as an energy infrastructure company. Valued at $62.5 billion by market cap, the company owns and operates pipelines that transport natural gas, gasoline, crude oil, carbon dioxide, and other products, as well as terminals that store petroleum products and chemicals and handle bulk materials like coal and petroleum coke.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and KMI definitely fits that description, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the oil & gas midstream industry. KMI is a key energy sector player with 82,000 miles of pipelines and 139 terminals, generating steady revenue through its vast infrastructure and strategic presence in major production areas. Its business model, driven by long-term, fee-based contracts, provides financial stability and supports consistent dividend payments, shielding it from commodity price volatility.

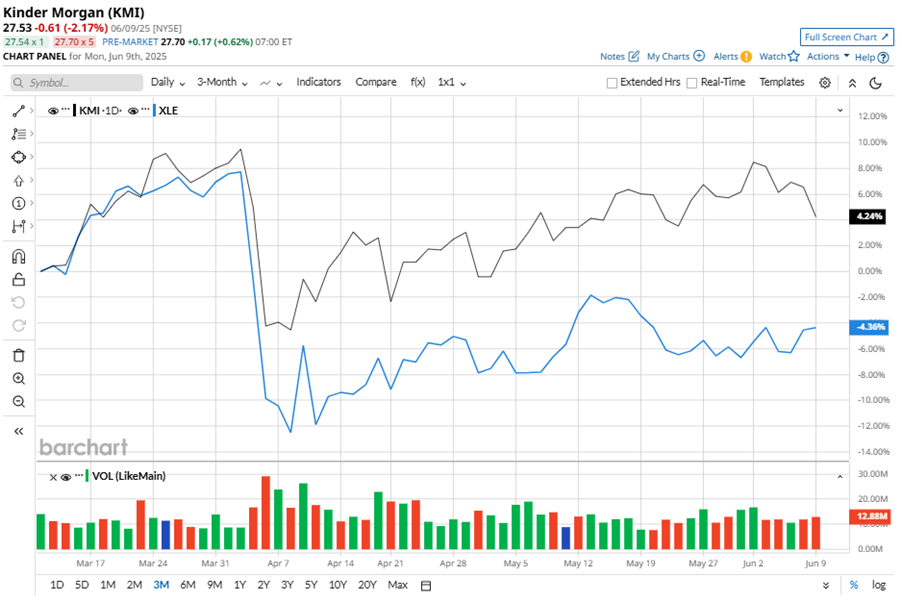

Despite its notable strength, KMI slipped 12.5% from its 52-week high of $31.48, achieved on Jan. 21. Over the past three months, KMI stock gained 5.3%, outperforming the Energy Select Sector SPDR Fund’s (XLE) 4.4% decline during the same time frame.

In the longer term, shares of KMI rose marginally on a YTD basis and climbed 40.3% over the past 52 weeks, outperforming XLE’s YTD losses of 2.4% and 7.1% drop over the last year.

To confirm the bullish trend, KMI has been trading above its 50-day moving average since early May. The stock is trading above its 200-day moving average over the past year, with slight fluctuations.

Kinder Morgan's outperformance is due to its leading position in midstream services aided by its long-term contracts that ensure steady revenues from pipeline and storage assets, insulated from volume fluctuations. The growing demand for natural gas in the U.S., driven by cleaner energy trends and industrial activity, provides a solid foundation for future growth. With $900 million in new projects added in the first quarter of 2025, Kinder Morgan's backlog now stands at $8.8 billion, ensuring stable cash flows for the future.

On Apr. 16, KMI shares closed down by 1% after reporting its Q1 results. Its adjusted EPS of $0.34 missed Wall Street expectations of $0.35. The company’s revenue stood at $4.2 billion, up 10.4% year over year. KMI expects full-year adjusted EPS to be $1.27.

In the competitive arena of oil & gas midstream, The Williams Companies, Inc. (WMB) has taken the lead over KMI, showing resilience with a 10.2% gain on a YTD basis and a 46.6% uptick over the past 52 weeks.

Wall Street analysts are moderately bullish on KMI’s prospects. The stock has a consensus “Moderate Buy” rating from the 17 analysts covering it, and the mean price target of $31.33 suggests a potential upside of 13.8% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.