What Are Wall Street Analysts' Target Price for Boeing Stock?

/Boeing%20Co_%20plane-by%20Wirestock%20via%20iStock.jpg)

Arlington, Virginia-based The Boeing Company (BA) is a leading global aerospace and defense manufacturer that designs, produces, and supports commercial jetliners, military aircraft, satellites, and space systems across over 150 countries. With a market cap of $167.8 billion, Boeing’s operations span the Americas, Indo-Pacific, Europe, and internationally.

The aircraft manufacturer has gained 25.6% on a YTD basis and 30.8% over the past 52 weeks, outshining the S&P 500 Index’s ($SPX) 7.6% rise in 2025 and 18.4% gains over the past year.

Zooming in further, Boeing has notably lagged behind the industry-focused SPDR S&P Aerospace & Defense ETF’s (XAR) 30.8% gains on a YTD basis and 51.2% surge over the past year.

On July 29, Boeing reported its Q2 2025 earnings, highlighting a strong recovery with total revenue surging 35% year-over-year to $22.7 billion, fueled by a 63% increase in commercial jet deliveries and steady growth across its defense and services segments. Commercial airplane revenue soared 81% to $10.9 billion, while the company’s total backlog expanded to $619 billion, backed by more than 5,900 aircraft orders. Boeing also made notable progress on the bottom line, with its core loss narrowing to $1.24 per share, beating Wall Street’s projections.

However, its shares dipped 4.4% post earnings release amid negative margins in its commercial aircraft unit, certification delays for key models like the 737 MAX 7/10 and 777-9, and ongoing safety and regulatory scrutiny.

For fiscal 2025, ending in December, analysts expect BA’s loss per share to narrow 88.5% year-over-year to $2.34. However, the company has a mixed earnings surprise history, having surpassed the estimates in two of the past four quarters while missing on two other occasions.

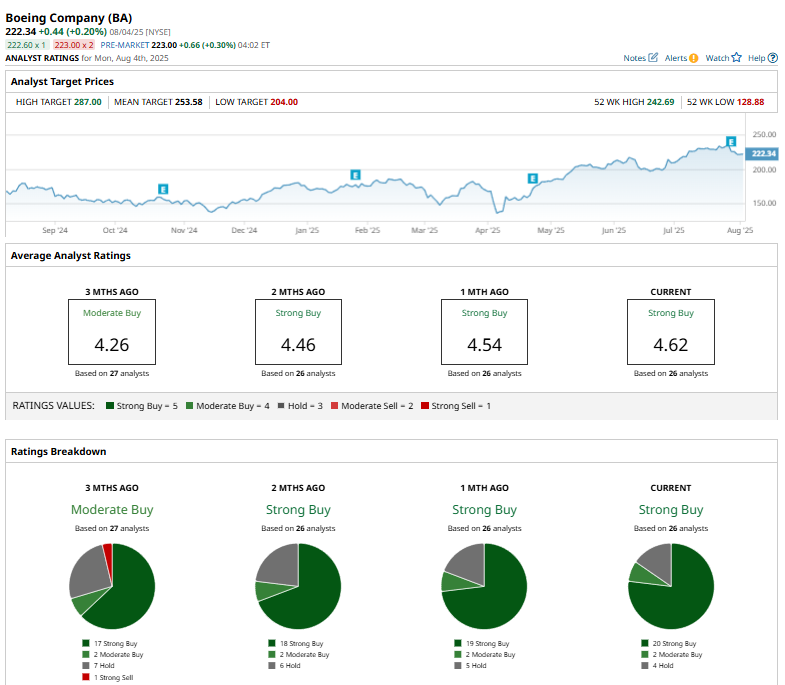

Boeing holds a consensus “Strong Buy” rating overall. Of the 26 analysts covering the stock, opinions include 20 “Strong Buys,” two “Moderate Buys,” and four “Holds.”

This configuration is slightly more bullish than a month ago, when 19 analysts gave “Strong Buy” recommendations.

On Aug. 1, BofA Securities analyst Ronald Epstein reiterated a "Buy" rating on Boeing and raised the price target from $260 to $270.

Boeing’s mean price target of $253.58 indicates a 14.1% premium to current price levels, while its Street-high target of $287 suggests a staggering 29.1% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.