How Is Carrier Global’s Stock Performance Compared to Other Building Products & Equipment Stocks

/Carrier%20Global%20Corp%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

Carrier Global Corporation (CARR), headquartered in Palm Beach Gardens, Florida, is a global leader in intelligent climate and energy solutions. With a strong foothold in HVAC, refrigeration, and building automation technologies, the company has transformed itself into a powerhouse shaping sustainable living worldwide. Today, Carrier boasts a market capitalization of $55.5 billion.

Companies worth $10 billion or more are typically classified as “large-cap stocks,” and CARR fits the category, with its market cap soaring past this threshold – underscoring the scale of its influence. This growth stems from its century-old brand legacy, cutting-edge R&D, and leadership in energy-efficient solutions. A diversified portfolio, global reach, and a loyal customer base have fueled its rise, cementing Carrier’s dominance in the building products and equipment space.

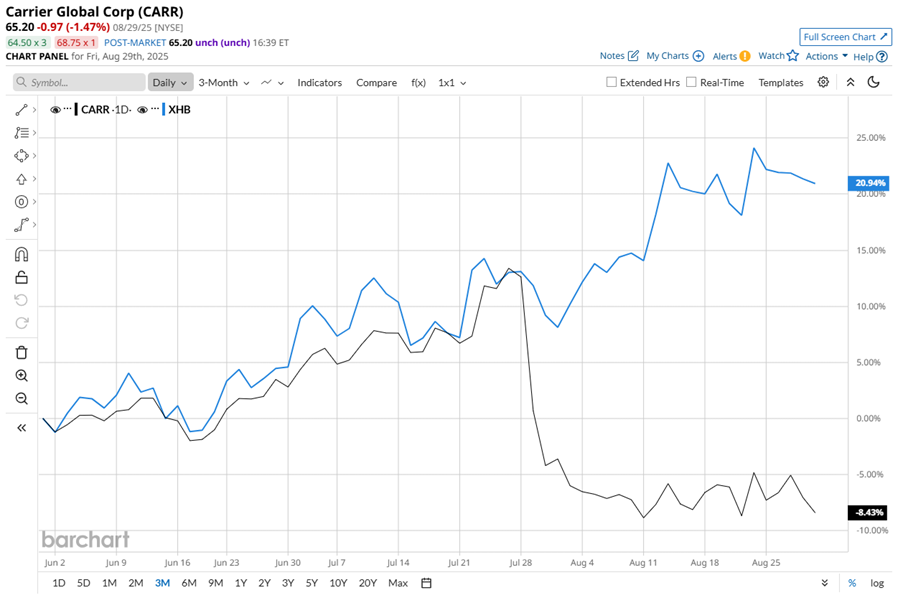

Despite Carrier Global’s strengths, the stock has been on a rough ride lately. From its 52-week high of $83.32, achieved on Oct. 15, it has slipped 21.8%, showing clear signs of fatigue. Over the past three months, the stock declined 8.7%, badly trailing the SPDR S&P Homebuilders ETF’s (XHB) 20.1% surge in the same stretch.

Zooming out, the past year has not been kinder either - shares are off 8.3%, compared with XHB’s modest 1.8% dip. Even 2025 has not sparked a turnaround yet, with the stock down 4.5% year-to-date (YTD) while XHB climbs 9.1%. Investors seem cautious, and momentum just has not returned, leaving CARR struggling to find its next breakout.

Weak momentum shadows CARR, with the stock pinned under its 50-day and 200-day moving averages since late July. The technicals hint at lingering bearish pressure, suggesting buyers remain cautious while sellers continue steering the trend.

Carrier Global has had a volatile stretch in the competitive building products and equipment space. After Carrier Global unveiled its Q2 earnings report on July 29, beating Wall Street’s expectations, CARR plunged nearly 11%.

The company’s net sales rose 3% year over year (YoY) to $6.1 billion with 6% organic growth, while adjusted EPS jumped 26% annually to $0.92 and operating margins improved to 19.1%. Investors looked past the headline numbers, focusing instead on persistent demand softness, margin pressures, and macroeconomic uncertainty.

U.S. residential and light commercial volumes slipped, while Europe grappled with weak boiler sales, and China’s housing slowdown hit Asia-Pacific performance. High interest rates kept homebuyers cautious, dragging construction activity. Despite reaffirming strong 2025 guidance, management’s warnings about slower volumes, sluggish markets, and margin deterioration spooked investors, overshadowing the upbeat results and driving the sharp sell-off.

In the building products and equipment industry, CARR has managed to hold up slightly better than its rival, AAON, Inc. (AAON). While AAON has tumbled 10.6% over the past 52 weeks and dropped 29.5% YTD, CARR’s losses have been less steep.

While Carrier Global has not escaped the red entirely, with its stock struggling over the past year, Wall Street has not lost faith. Among the 24 analysts covering the stock, the consensus rating stands at a “Moderate Buy,” and the mean price target of $84.28 hints at a potential upside of 29.3% from current levels.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.