Is Paccar Stock Underperforming the Nasdaq?

/Paccar%20Inc_%20logo%20on%20phone%20and%20chart-by%20T_Schneider%20via%20Shutterstock.jpg)

Valued at approximately $52.5 billion by market capitalization, Washington-based Paccar Inc (PCAR) is a global leader in the production of heavy-duty trucks and also maintains a notable presence in the light- and medium-duty truck segment. In addition to vehicles, the company designs and manufactures diesel engines and other powertrain components, both for its own lineup and for third-party truck and bus makers.

Companies valued at $10 billion or more are generally classified as "large-cap" stocks, and Paccar falls squarely into this category, with a market capitalization that exceeds this threshold. The company plays a vital role in global commerce, with its Kenworth, Peterbilt, and DAF trucks recognized worldwide for their quality, durability, and innovation. These brands have built strong customer loyalty and a sense of pride of ownership, while the company’s operational efficiency and premium pricing consistently support its financial performance.

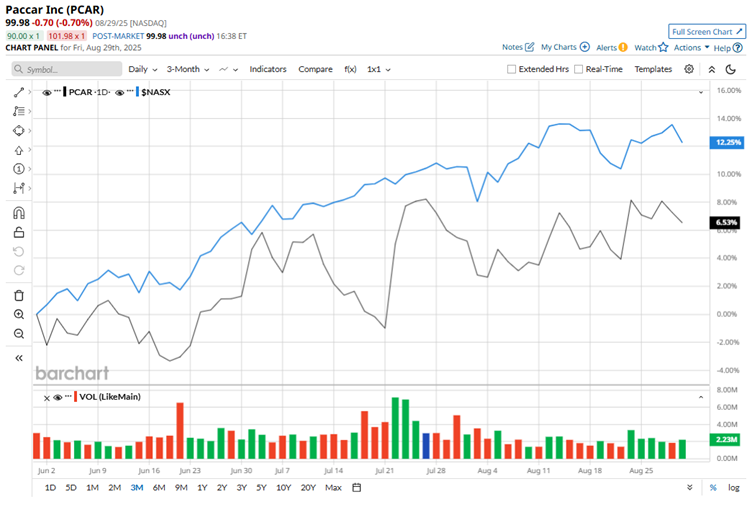

However, the share price movement reflects the ongoing challenges facing the company. Shares of this industrial giant have pulled back almost 15.9% from its 52-week high of $118.81 achieved last December. Over the past three months, the stock has been up roughly 6%, lagging behind the Nasdaq Composite's ($NASX) 11.9% return during the same stretch.

Focusing on the longer-term performance, we see that PCAR stock has shot up 5.8% over the past year, while the NASX has gained 22.2%. So far this year, the stock has tanked 3.9%, significantly trailing behind the broader index, which has surged 11.1% on a year-to-date (YTD) basis.

PCAR’s stock has struggled to reclaim long-term momentum, holding below its 200-day moving average since mid-March. Yet, shorter-term sentiment has shown signs of improvement, with shares climbing above the 50-day moving average in mid-May and managing to stay there despite some interim volatility.

Investor sentiment toward PCAR has been muted amid sector-wide challenges like supply chain pressures and uneven demand, leaving the stock struggling to gain traction. That said, shares jumped 6.1% on Jul. 22 after the company topped expectations in its fiscal 2025 Q2 earnings report.

Earnings came in at $1.37 per share, above the $1.28 forecast, while revenue of $6.96 billion also edged past estimates of $6.79 billion. Still, the headline beat masked deeper challenges. Sales were down 15.7% from last year, and profits per share fell an even steeper 35.6% year over year, underscoring the company’s struggles.

To emphasize the extent of the stock's underperformance, it’s worth noting that PCAR’s rival, Caterpillar (CAT), has skyrocketed 20.3% over the past year and added another 15.5% in 2025, sharply outpacing PCAR’s returns.

On the bright side, despite PCAR’s sluggish price action, Wall Street maintains a cautiously optimistic stance. Of the 19 analysts covering the stock, the consensus rating stands at “Moderate Buy,” with an average price target of $103.94, implying about 4% upside from current levels.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.