Is American Express Stock Outperforming the Dow?

/American%20Express%20Co_%20credid%20card-by%20RYO%20Alexandre%20via%20Shutterstock.jpg)

American Express Company (AXP), boasting a market cap of around $230.5 billion and headquartered in New York, stands among the world’s foremost diversified financial services providers with strong roots in payments and travel. The company delivers a comprehensive suite of offerings that span credit and charge cards, merchant acquiring solutions, and travel-related products, reaching both individual consumers and businesses across the globe.

Companies worth $200 billion or more are generally described as “mega-cap stocks,” and American Express firmly fits the category. Mega-cap companies are typically known for their financial stability, established market presence, and consistent revenue streams, all qualities that American Express demonstrates through its strong brand reputation, diversified financial services, and global customer base. With its extensive service ecosystem and global reach, American Express maintains a prominent position in the competitive financial services landscape.

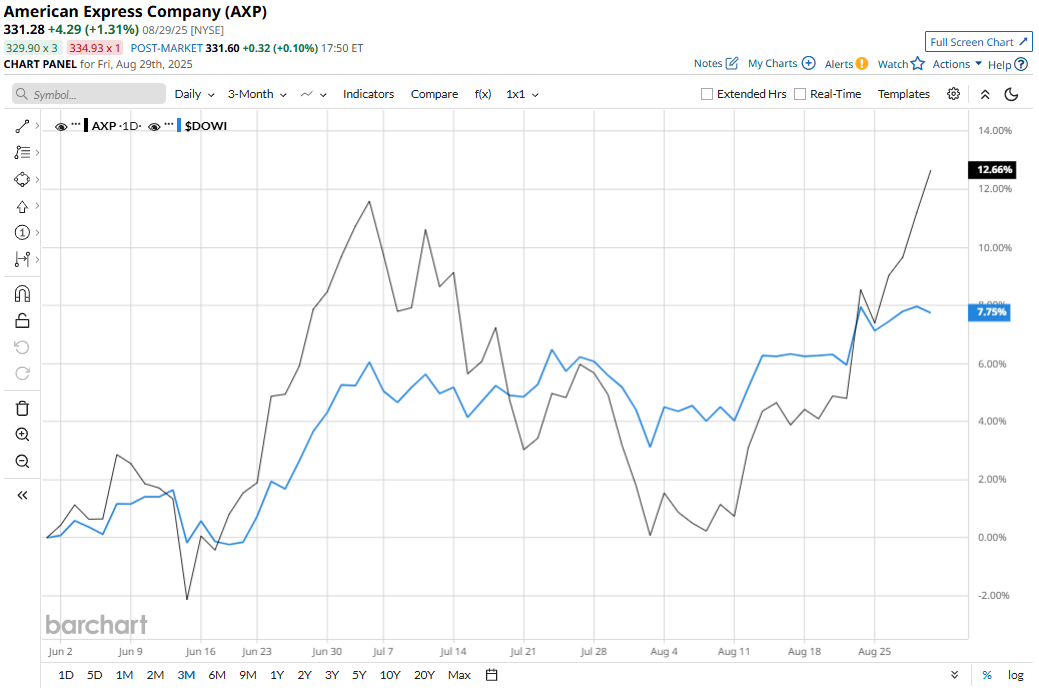

Confirming its notable strength, AXP stock reached a fresh 52-week high of $332.06 on Aug. 29, before slightly pulling back. Also, over the past three months, the stock gained 12.2%, outperforming the Dow Jones Industrial Average’s ($DOWI) 7.9% gains during the same time frame.

Longer term, AXP has delivered 11.6% returns on a year-to-date (YTD) basis, outpacing the Dow’s 7.1% gains. Plus, the stock has surged 28.9% over the past 52 weeks, compared to Dow Jones’ 10.8% returns over the same period.

To confirm the uptrend, AXP has traded mostly above its 50-day and 200-day moving averages over the past year, with some fluctuations. It has consistently remained above its 200-day moving average since early May.

AXP has delivered a stellar performance, and several key factors help explain this divergence. American Express has benefited from strong underlying fundamentals, solid revenue growth, resilient earnings, and robust spending by its affluent customer base, which have buoyed investor confidence.

American Express released its Q2 2025 earnings report on July 18, delivering a standout performance. Adjusted EPS hit $4.08, up 17% year-over-year (YoY) and outperforming the consensus estimate, while revenue rose 9% to $17.9 billion. This was fueled by record Card Member spending, higher net interest income amid growth in revolving loan balances, and steady card fee growth.

Although AmEx has delivered a strong showing on Wall Street in 2025, its stock has lagged behind peer Mastercard Incorporated (MA), which has climbed 13.1% YTD. However, AXP has outpaced Mastercard over the past 52 weeks, as MA recorded 26.2% gains.

Analysts are cautiously optimistic about AXP stock’s prospects. The stock has a consensus rating of “Moderate Buy” from the 30 analysts covering the stock, and the stock is currently trading above the mean price target of $322.84. Yet, the Street high of $375 implies an upside of 12.2%.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.