How Is NextEra Energy’s Stock Performance Compared to Other Utility Stocks?

Headquartered in Juno Beach, Florida, NextEra Energy, Inc. (NEE) generates, transmits, distributes, and sells electric power. The company operates approximately 35,052 megawatts of net generating capacity, supported by roughly 91,000 circuit miles of transmission and distribution lines and 921 substations.

With a market cap of approximately $148.4 billion, it serves about 12 million people through nearly 6 million customer accounts along Florida’s east and lower west coasts. Companies worth $10 billion or more are generally described as “large-cap” stocks, and NextEra’s market cap places it firmly in the “large-cap” category, highlighting its substantial size, operational stability, and influence within the Utilities sector.

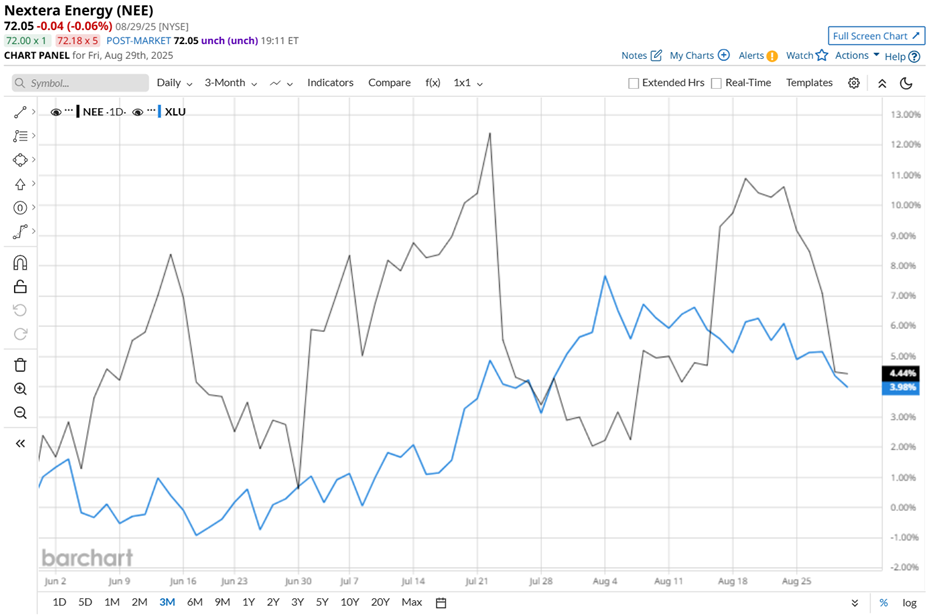

Shares of NextEra Energy are trading roughly 16.3% below the October 2024 high of $86.10. Over the past three months, the stock has gained nearly 4.4%, edging past the S&P 500 Utilities Sector SPDR (XLU), which rose close to 4% in the same period.

Looking at a longer horizon, the utility stock remains down 9.3% over the past 52 weeks, though it is holding onto a marginal year-to-date (YTD) gain. By comparison, XLU has advanced nearly 12% over the past 52 weeks and 11.4% so far in 2025.

NEE’s price momentum has been volatile. For most of the past year, the stock sat under its 200-day moving average, a clear cap on bullish hopes. But since July, it has nudged above that line despite some fluctuations, and by early August, firmly reclaimed it, hinting at renewed strength. traded above its 50-day moving average from May but slipped below it in late August, signaling caution despite improving long-term trends.

The technical picture shows mixed momentum - longer-term sentiment looks more constructive, yet near-term weakness keeps traders on edge, leaving the stock straddling a fine line between recovery and hesitation.

NEE stock experienced a 6.1% drop following the release of Q2 fiscal 2025 results on July 23 and lingered under negative momentum for the subsequent three trading sessions. Revenue rose 10.4% year over year (YoY) to $6.7 billion, reflecting continued demand growth, but fell short of Street expectations of $7.3 billion, rattling investor confidence. On the brighter side, adjusted EPS grew 9.4% annually to $1.05, surpassing Wall Street estimates of $0.98.

When compared to its industry peer, the contrast becomes clear. Rival American Electric Power Company, Inc. (AEP) has delivered strong gains, posting 12.7% returns over the past 52 weeks and 20.4% YTD, highlighting NEE’s relative underperformance.

Even with recent setbacks, analysts remain confident in NEE’s long-term trajectory. The stock has received a consensus rating of “Moderate Buy” from the 21 analysts in coverage, and the mean price target of $82.17 is a premium of 14% to current levels.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.