Is Coca-Cola Stock Underperforming the Dow?

The Coca-Cola Company (KO), headquartered in Atlanta, Georgia, is a beverage company that manufactures, markets, and sells a range of nonalcoholic beverages worldwide. With a market cap of $296.9 billion, the company also distributes and markets juice and juice-drink products to retailers and wholesalers worldwide.

Companies worth $200 billion or more are generally described as “mega-cap stocks,” and KO definitely fits that description, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the non-alcoholic beverages industry. KO's iconic brand recognition and diverse product portfolio give it a competitive edge. With a vast distribution network, its products are widely available, catering to varied consumer tastes and preferences globally.

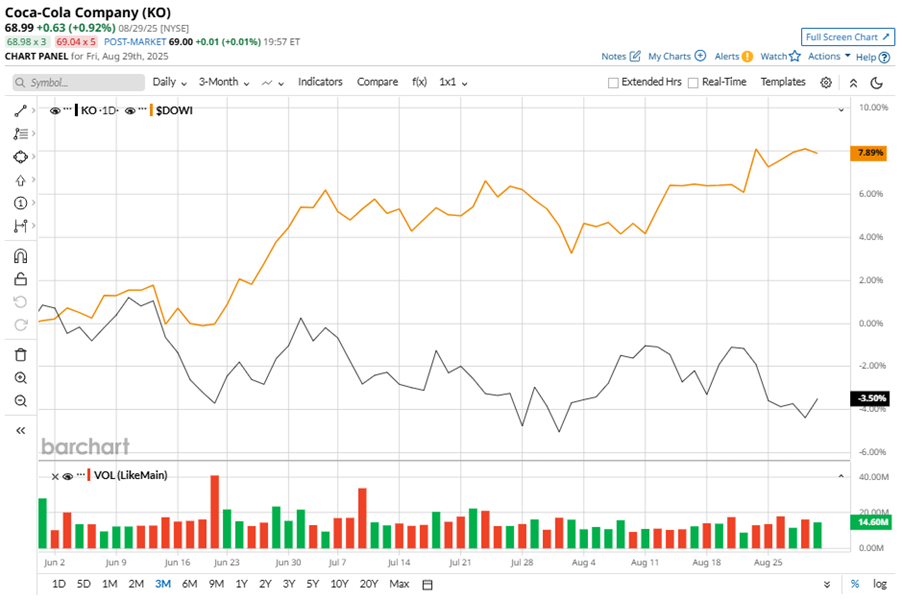

Despite its notable strength, KO slipped 7.2% from its 52-week high of $74.38, achieved on Apr. 22. Over the past three months, KO stock declined 3.5% underperforming the Dow Jones Industrials Average’s ($DOWI) 7.9% gains during the same time frame.

In the longer term, shares of KO rose 10.8% on a YTD basis, outperforming DOWI’s YTD gains of 7.1%. However, the stock has fallen 3.9% over the past 52 weeks, underperforming DOWI’s 10.8% returns over the same period.

To confirm the bullish trend, KO has been trading above its 200-day moving average since mid-February, with slight fluctuations. However, the stock is trading below its 50-day moving average since mid-June, with some fluctuations.

Coca-Cola's underperformance is attributed to volume pressures in key markets, driven by evolving consumer behavior, economic challenges, and inflationary pressures. Volume declines were seen in regions like North America, Europe, Latin America, and the Asia Pacific due to softer demand and affordability issues.

On Jul. 22, KO shares closed down marginally after reporting its Q2 results. Its adjusted EPS came in at $0.87, up 3.6% year-over-year. The company’s adjusted revenue stood at $12.6 billion, up 2.5% from the year-ago quarter.

In the competitive arena of non-alcoholic beverages, PepsiCo, Inc. (PEP) has lagged behind the stock, showing resilience with a 2.2% loss on a YTD basis and a 14.5% downtick over the past 52 weeks.

Wall Street analysts are bullish on KO’s prospects. The stock has a consensus “Strong Buy” rating from the 24 analysts covering it, and the mean price target of $79.91 suggests a potential upside of 15.8% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.