How Is Arthur J. Gallagher’s Stock Performance Compared to Other Insurance Stocks?

/Arthur%20J_%20Gallagher%20%26%20Co_%20logo%20and%20data-%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

With a market capitalization of roughly $77.6 billion, Illinois-based Arthur J. Gallagher & Co. (AJG) is a leading international service provider that plans, designs, and administers a full suite of customized, cost-effective property/casualty insurance and risk management programs, consulting services, and third-party claims settlement across the U.S. and globally.

Companies with a valuation above $10 billion are generally considered “large-cap” stocks, and Gallagher firmly belongs in this category with a market cap well beyond that threshold. The company delivers its services in nearly 130 countries through its owned operations as well as a strong network of correspondent brokers and consultants, reinforcing its position as a global leader in the insurance and risk management space.

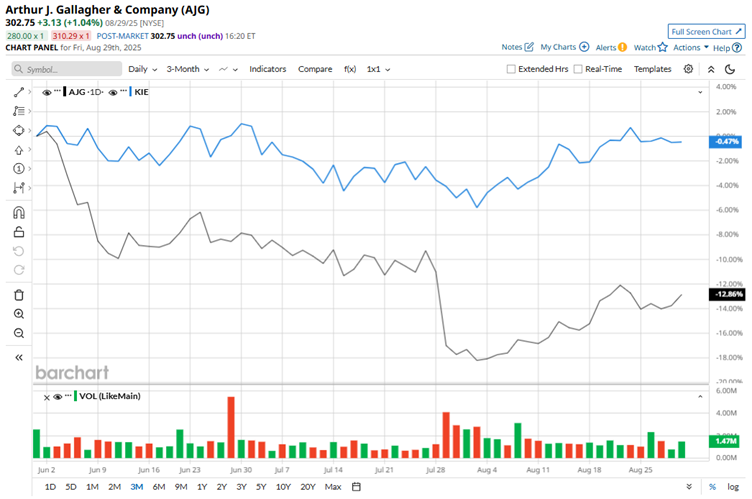

After reaching a 52-week high of $351.23 on Jun. 3, AJG has seen its momentum fade, with the stock sliding 13.8% from that peak. The weakness has been even more evident in recent months. Shares have tumbled nearly 11.5% over the past three months, sharply underperforming the SPDR S&P Insurance ETF’s (KIE) marginal return during the same period.

Over the 52 weeks, AJG has managed a modest 4.1% gain, with year-to-date (YTD) performance showing a stronger 6.7% climb. By comparison, the KIE has delivered a slightly higher 5.7% return over the past year but trails AJG on a YTD basis with a 4.1% gain.

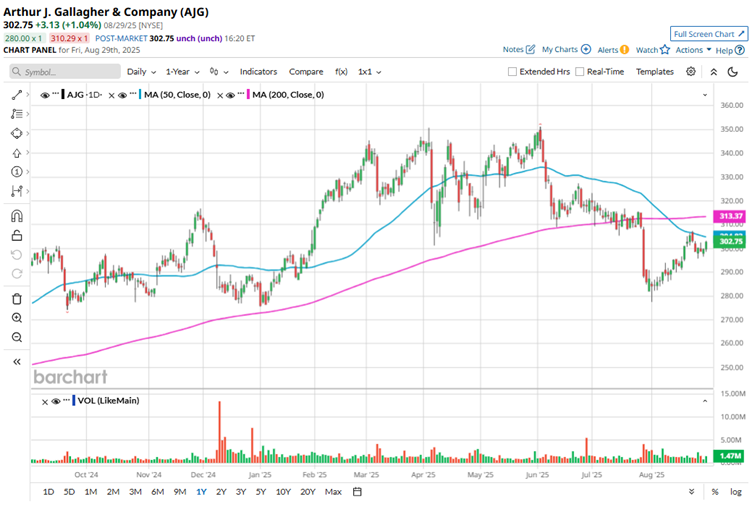

To confirm the bearish price trend, AJG has slipped beneath both its 50-day and 200-day moving averages since the end of July, indicating persistent downward pressure on the stock.

On July 31, AJG reported its Q2 results, highlighting robust top-line momentum with revenue climbing 16% year-over-year and organic growth of 5.4%. The company also benefited from healthy adjusted EBITDAC margins and continued progress on acquisitions and technology-driven initiatives. However, investor excitement was somewhat muted, as adjusted EPS of $2.33 fell just short of estimates, underscoring modest earnings misses despite the company’s strong growth trajectory.

Meanwhile, AJG’s peer Aon plc (AON) has delivered a stronger showing over the past year with an 8.1% gain, outpacing Gallagher’s performance. However, in 2025, the tables have turned. Aon is up a modest 2.2% this year, trailing behind AJG’s healthier advance.

On the bright side, despite AJG’s mixed price action, Wall Street maintains a cautiously optimistic stance. Of the 21 analysts covering the stock, the consensus rating stands at “Moderate Buy,” with an average price target of $337.50, implying about 11.5% upside from current levels.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.