Is Danaher Stock Underperforming the Dow?

/Danaher%20Corp_%20logo%20on%20vial-by%20Melnilov%20Dmitriy%20via%20Shutterstock.jpg)

With a market cap of $147.4 billion, Danaher Corporation (DHR) is a global science and technology innovator that designs, manufactures, and markets professional, medical, research, and industrial products across the United States, China, and worldwide. Operating through its Biotechnology, Life Sciences, and Diagnostics segments, the company provides advanced tools, technologies, and services that support healthcare, scientific research, and industrial applications.

Companies valued at $10 billion or more are generally considered “large-cap” stocks, and Danaher fits this criterion perfectly. Headquartered in Washington, the District Of Columbia, Danaher has built a strong presence in diverse industries, partnering with leading organizations to drive innovation in diagnostics, therapeutics, and applied solutions.

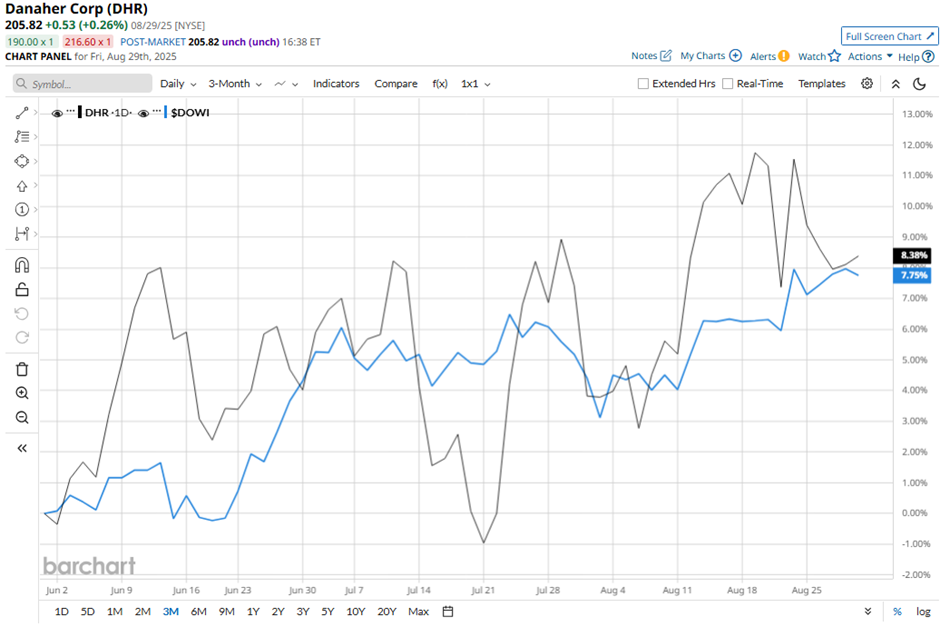

Shares of the industrial and medical device maker have declined 26.5% from its 52-week high of $279.90. Over the past three months, its shares have increased 8.1%, slightly outperforming the broader Dow Jones Industrials Average's ($DOWI) 7.9% rise during the same period.

Longer term, DHR stock is down 10.3% on a YTD basis, lagging behind DOWI's 7.1% gain. Moreover, shares of the company have dipped 22.6% over the past 52 weeks, compared to DOWI’s 10.8% return over the same time frame.

The stock has been in a bearish trend, consistently trading below its 200-day moving average since late-October last year.

Shares of Danaher rose nearly 1% on Jul. 22 after the company posted Q2 2025 adjusted EPS of $1.80 and revenue of $5.9 billion, ahead of forecasts. The company also raised its annual adjusted EPS guidance to $7.70 - $7.80, citing steady bioprocessing demand and signs of recovery in China despite ongoing policy pressures. Investor sentiment was further boosted by the management’s outlook for high single-digit long-term growth in bioprocessing, driven by robust investment in monoclonal antibodies, which account for more than 75% of bioprocessing revenues.

However, DHR stock has performed weaker than its rival, IDEXX Laboratories, Inc. (IDXX). IDXX stock has climbed 56.5% YTD and 34.4% over the past 52 weeks.

Despite the stock’s underperformance over the past year, analysts remain bullish about its prospects. DHR stock has a consensus rating of “Strong Buy” from 24 analysts in coverage, and the mean price target of $243.33 is a premium of 18.2% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.