Edwards Lifesciences Stock: Is EW Outperforming the Healthcare Sector?

/Edwards%20Lifesciences%20Corp%20Irvine%2C%20Ca%20campus-by%20Steve%20Cukrov%20via%20Shutterstock.jpg)

Valued at approximately $47.8 billion by market capitalization, California-based Edwards Lifesciences Corporation (EW) develops products and technologies to treat advanced cardiovascular diseases across the United States, Europe, Japan, and other international markets. Companies with valuations of $10 billion or more are generally classified as “large-cap” stocks, and Edwards Lifesciences comfortably fits into this category.

As the world’s leading structural heart innovation company, Edwards Lifesciences is driven by its mission to improve patient outcomes. Through breakthrough technologies, robust clinical evidence, and close collaboration with clinicians and healthcare partners, the company continues to deliver meaningful advances in cardiovascular care, guided by a strong patient-centered culture.

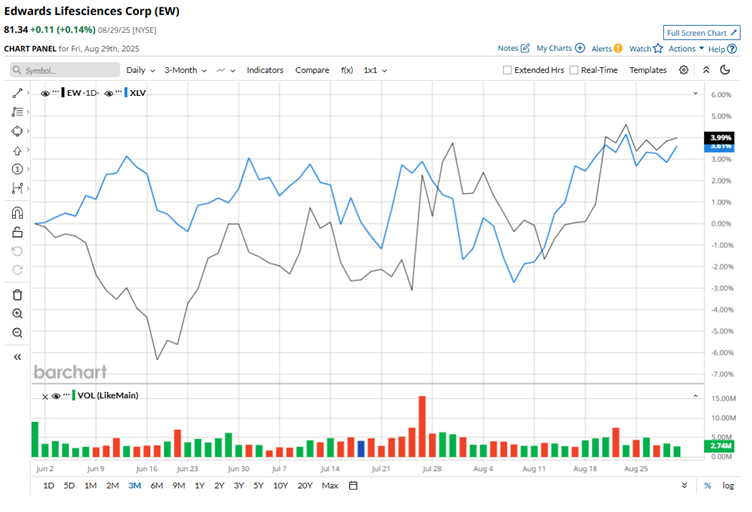

The medical device maker has been trading near record levels, recently touching a 52-week high of $83 in July and retreating just 2% from that peak. In the past three months, the stock has advanced about 4.6%, edging past the 3.8% return of the Health Care Select Sector SPDR Fund (XLV) over the same period.

On a longer horizon, the outperformance is even more evident. EW is up 18.5% over the past year and has added 9.9% in 2025. In contrast, XLV has declined by almost 11.8% over the past year and remains marginally down on a year-to-date (YTD) basis, highlighting Edwards’ ability to deliver steady gains in a sector facing broader headwinds.

To highlight its bullish trend, Edwards Lifesciences has stayed firmly above its 200-day moving average since April, signaling strong underlying momentum. The stock has also managed to hold above its 50-day moving average over the same period, weathering bouts of volatility along the way.

Edwards Lifesciences has been riding the momentum from the strong performance of its innovative medical device pipeline. The boost was evident following its fiscal 2025 second-quarter earnings release on Jul. 24, which topped Wall Street’s expectations on both revenue and profit. Shares climbed nearly 5.5% the next trading day as investors cheered the results. Quarterly sales totaled $1.53 billion, representing an 11% year-over-year increase, with growth spread across all product categories. On the other hand, adjusted earnings per share also rose to $0.67, marking an 8.1% increase from the prior year.

In the competitive healthcare landscape, EW has clearly outpaced its peer Medtronic plc (MDT), delivering double-digit gains over the past year compared to MDT’s modest 5.1% rise. However, the story shifts on a year-to-date basis. While EW is up single digits in 2025, Medtronic has surged ahead with a 16.2% gain.

Nevertheless, building on EW’s solid price momentum against the broader healthcare sector, Wall Street’s outlook remains constructive. Of the 31 analysts covering the stock, the consensus recommendation comes in at a “Moderate Buy,” underscoring steady confidence in its trajectory. The average price target stands at $87.31, implying roughly 7.3% upside from current levels.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.