Is Union Pacific Stock Underperforming the Nasdaq?

/Union%20Pacific%20Corp_%20logo%20on%20side%20of%20train%20car-by%20Joseph%20Creamer%20via%20Shutterstock.jpg)

With a market cap of $132.6 billion, Union Pacific Corporation (UNP) is the largest railroad operator in North America. Through its principal subsidiary, Union Pacific Railroad Company, it provides rail transportation services across 23 U.S. states, connecting key Pacific and Gulf Coast ports with the Midwest and eastern gateways.

Companies valued at $10 billion or more are generally considered "large-cap" stocks, and Union Pacific fits this criterion perfectly. It serves a wide range of industries, transporting agricultural products, automotive goods, chemicals, coal, industrial products, and intermodal containers. Union Pacific also links with Canada’s rail systems and uniquely serves all six major gateways to Mexico.

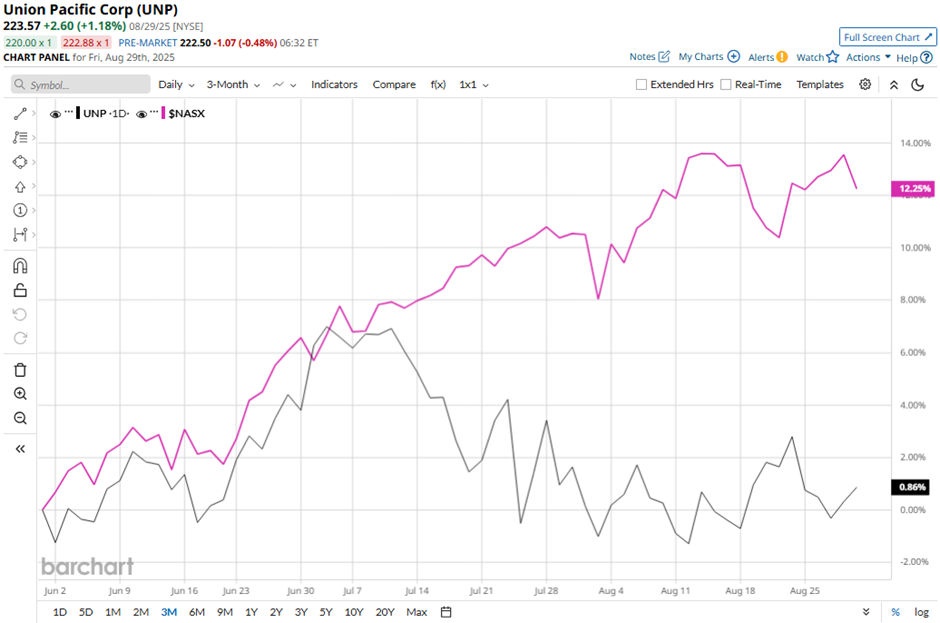

Despite this, shares of the Omaha, Nebraska-based company have declined 13.4% from its 52-week high of $258.07. UNP stock has risen marginally over the past three months, underperforming the Nasdaq Composite’s ($NASX) 11.9% increase over the same time frame.

In the longer term, Union Pacific stock is down nearly 2% on a YTD basis, lagging behind NASX’s 11.1% gain. Moreover, shares of the railroad have decreased 11.5% over the past 52 weeks, compared to NASX’s 22.2% return over the same time frame.

Despite few fluctuations, UNP stock has been trading mostly below its 50-day and 200-day moving averages since early March.

Despite reporting better-than-expected Q2 2025 adjusted EPS of $3.03, Union Pacific’s stock fell 4.5% on Jul. 24 because revenue of $6.15 billion was essentially flat and slightly below the consensus. Investors were also concerned that the adjusted operating ratio deteriorated by 230 basis points year-over-year to 58.1%, signaling weaker efficiency despite higher coal, grain, and chemical shipments.

In contrast, rival Norfolk Southern Corporation (NSC) has outpaced UNP stock. Shares of Norfolk Southern have soared 19.3% on a YTD basis and 11.9% over the past 52 weeks.

Despite the stock’s underperformance, analysts remain moderately optimistic on Union Pacific. The stock has a consensus rating of “Moderate Buy” from 25 analysts in coverage, and the mean price target of $261.09 is a premium of 16.8% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.