Is Micron Technology Stock Outperforming the Dow?

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

With a market cap of $133.2 billion, Micron Technology, Inc. (MU) is a global leader in high-performance memory and storage solutions. Through its well-known brands Micron, Crucial, and Ballistix, the company develops and markets technologies including DRAM, NAND, NOR Flash, and advanced 3D memory innovations.

Companies valued at $10 billion or more are generally considered "large-cap" stocks, and Micron Technology fits this criterion perfectly. Serving diverse markets such as data centers, mobile, automotive, industrial, and consumer electronics, Micron operates worldwide with a broad sales and distribution network.

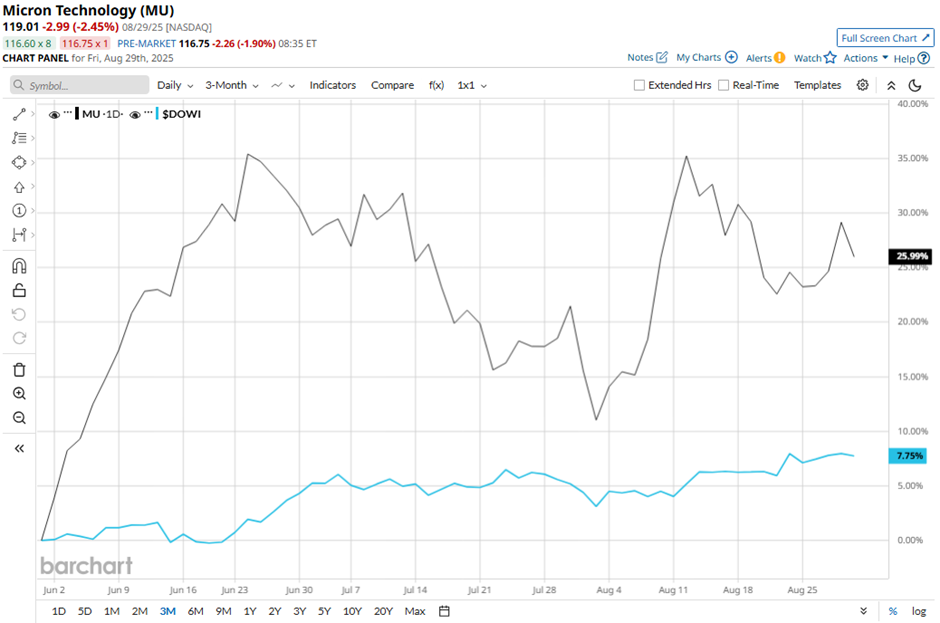

Shares of the Boise, Idaho-based company have declined 8.4% from its 52-week high of $129.85. Over the past three months, Micron Technology's shares have surged 22.9%, outperforming the broader Dow Jones Industrials Average's ($DOWI) 7.9% rise during the same period.

Longer term, MU stock has climbed 41.4% on a YTD basis, outpacing DOWI's 7.1% gain. Moreover, shares of the chipmaker have increased 25.5% over the past 52 weeks, compared to DOWI’s 10.8% return over the same time frame.

MU stock has been trading above its 200-day moving averages since early May.

Micron reported a strong fiscal Q3 2025 report on Jun. 25 that beat Wall Street expectations, with revenue surging 37% year-over-year to $9.3 billion and adjusted EPS jumping 208% to $1.91. The surge was driven by explosive demand for high-bandwidth memory (HBM) used in AI accelerators, with HBM revenue growing 50% quarter-over-quarter and overall data center revenue more than doubling year-over-year. Investor optimism was further fueled by strong forward guidance, including Q4 revenue projected at $10.4 billion - $11 billion and adjusted EPS of $2.35 - $2.65. However, the stock fell nearly 1% the next day.

In comparison, MU stock has performed stronger than its rival, Analog Devices, Inc. (ADI). ADI stock has returned 16.4% on a YTD basis and 5.3% over the past 52 weeks.

Due to the stock’s outperformance, analysts remain bullish about its prospects. MU stock has a consensus rating of “Strong Buy” from 36 analysts in coverage, and the mean price target of $152.50 is a premium of 28.1% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.