Warren Buffett Is Doubling Down on This 1 Stock. Should You Buy Shares Here?

The month of August has been a defining moment for Japan's trading giants. One of their biggest companies was propelled into the financial spotlight by a dramatic move from none other than legendary investor Warren Buffett. On Aug. 28, 2025, Berkshire Hathaway (BRK.A) (BRK.B), confirmed it had boosted its position in Mitsubishi Corporation (MSBHF), crossing the influential 10% ownership mark for the first time.

This development comes as global uncertainty intensifies, driven most recently by the United States’ newly imposed tariffs on key imports, and now puts Mitsubishi squarely at the center of fresh investor speculation. The timing couldn't be more intriguing.

With a year-to-date (YTD) share price gain of over 39%, Mitsubishi delivered a strong performance in its latest quarter, with consolidated net income reaching ¥203.1 billion ($1.4 billion). That’s already 29% of its full-year target. So the timely question is this: with Buffett doubling down and Mitsubishi’s numbers firming up, is this the moment to build a position? Let’s dive in.

Mitsubishi Q1 FY2026 Earnings Check

Mitsubishi Corporation stands as one of Japan’s most far-reaching conglomerates, active in energy, commodities, and consumer goods, with a market capitalization of $89.9 billion. The stock boasts a YTD gain of 43%, a 52-week advance of 12%, and a current price of $23.24.

A look at the valuation reveals that Mitsubishi is priced at a trailing and forward price-to-earnings (P/E) ratio of 16.88, noticeably lower than the sector medians of 21.53x and 21.01x. The price-to-book (P/B) ratio is a conservative 1.37, against the wider sector’s 3.19x. These numbers position Mitsubishi as a standout for value-oriented investors seeking both quality and underappreciated upside.

The company’s Q1 FY2026 earnings, released on Aug. 4, 2025, provide key context for Buffett’s interest. MSBHF posted an underlying operating cash flow of ¥250.4 billion ($1.70 billion). This represents 28% of the full-year target of ¥900 billion ($6.12 billion), confirming healthy progress. Performance can vary across units due to the timing of dividend receipts, but the trajectory remains on plan.

Net income for the quarter was ¥203.1 billion ($1.4 billion). That’s 29% progress against the company’s full-year goal of ¥700 billion ($4.76 billion), a solid achievement in just one quarter. The result also benefited from capital recycling and select one-off gains across multiple divisions, showing that Mitsubishi’s diversified model continues to deliver.

Strategic capital returns remain a top priority. Mitsubishi’s ¥1 trillion ($6.8 billion) share buyback plan, announced in April 2025, is making steady headway. As of June 30, 2025, the company had already repurchased ¥347.3 billion ($2.36 billion) in shares, demonstrating clear alignment with shareholders. However, this means dividend distributions have been paused for now to support these efforts and maintain financial flexibility.

Mitsubishi's Blueprint for Future Growth

Mitsubishi’s recent moves reveal a company sharpening its focus on projects that match both its ambitions and the realities of global markets. The July 2025 announcement stands out. Mitsubishi, alongside Par Pacific Holdings (PARR) and ENEOS Corporation, launched Hawaii Renewables. This joint venture will produce renewable fuels at Par Pacific’s refinery in Kapolei, Hawaii.

Mitsubishi and ENEOS will invest $100 million for a 36.5% equity stake, aiming to tap into growing U.S. and global demand for cleaner energy sources. This investment signals Mitsubishi’s commitment to sectors with long-term upside, using both cash and industry partnerships to secure a place in the energy transition. It is a pragmatic bet.

But the company is not simply chasing every opportunity. In August, Mitsubishi decided to withdraw from three large offshore wind projects in Japan after costs surged. Supply chain delays, heated inflation, and rising rates forced a tough choice. Construction expenses more than doubled, putting returns in question. The decision came after an earlier hit in February, when Mitsubishi recorded a ¥52.2 billion, or $354 million, loss related to these wind assets.

CEO Katsuya Nakanishi addressed the reality head-on, stating the projects were no longer feasible. The company explored all options, but discipline won out. Resources are now targeted at priorities with more stable fundamentals and better return prospects. This approach shows an ability to adapt quickly while avoiding high-risk undertakings that can drain shareholder value.

Analysts’ Outlook on Buffett's Raised Stake

Analysts see a mixed but improving earnings path that complements the renewed attention on Mitsubishi after Buffett’s stake increase. There is no posted next earnings release date yet, but fiscal year estimates fill the gap with useful direction. The average earnings estimate stands at 1.36 for FY 03/2026 and 1.51 for FY 03/2027, versus prior year figures of 1.56 and 1.36, respectively. That implies a near-term contraction of -12.82% year over year, followed by an expected rebound of +11.03%.

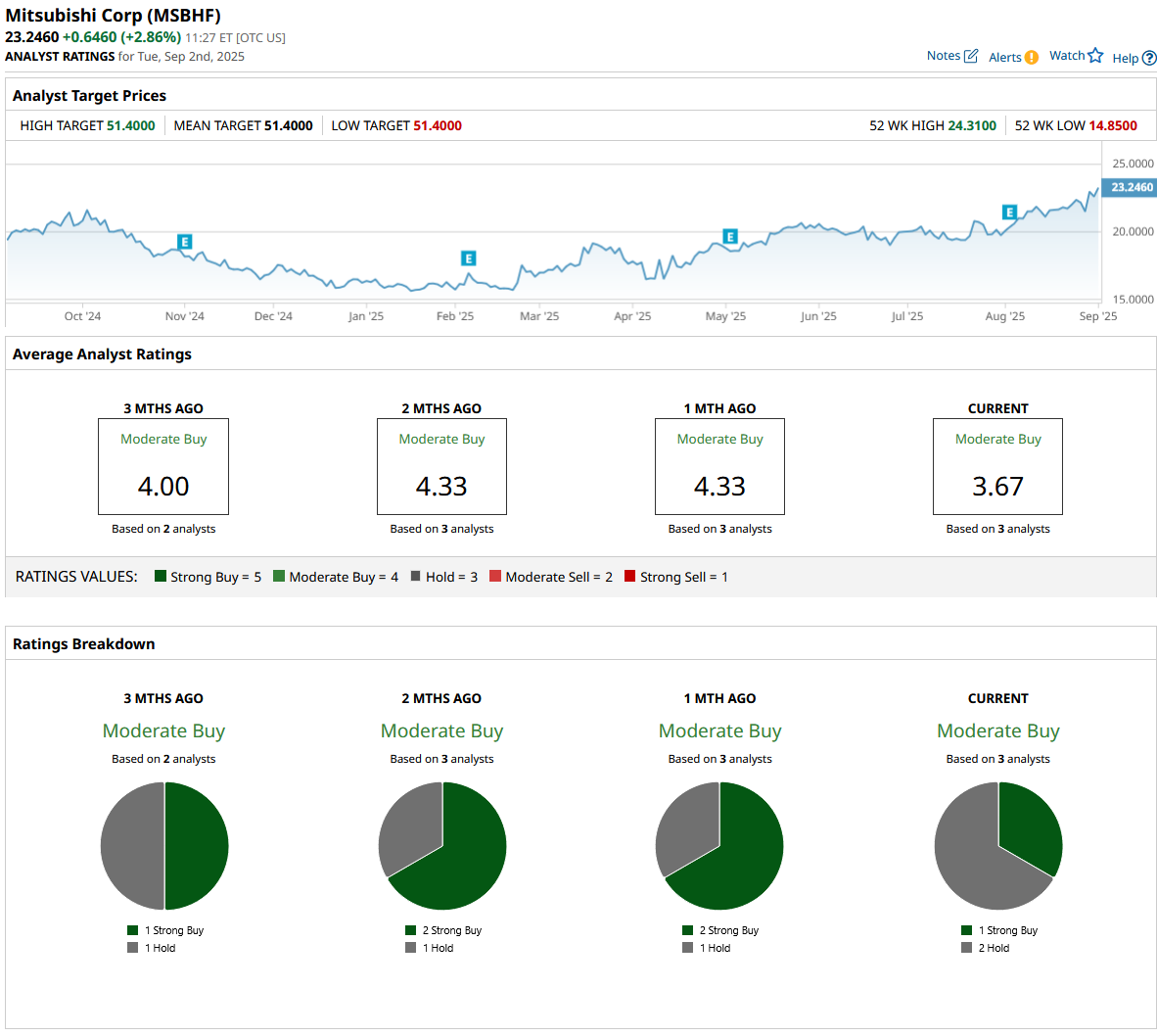

That setup has not dampened sentiment. All three analysts surveyed rate MSBHF at a consensus “Moderate Buy,” which signals constructive conviction even as earnings normalize from a high base. The average 12-month price target sits at $51.40 against a current price of $23.24. On simple math, that implies roughly a 121% upside from here, a gap large enough to suggest the market is still discounting Mitsubishi’s cash engines and capital discipline.

Conclusion

Buffett sees value here, not just another trade. Mitsubishi is delivering strong results and actively rewarding shareholders, making it likely MSBHF stock moves higher from these levels. Investor sentiment is steadily improving as buybacks accelerate and earnings remain consistent. Purely based on the company’s performance and Buffett’s conviction, this setup feels like one of the more appealing risk-reward opportunities out there. The next leg higher could come sooner than many expect.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.