As Intel Nabs $5.7 Billion in U.S. Cash, Should You Buy INTC Stock?

Semiconductor stocks have always been central to U.S. technology leadership, but in recent years, they’ve also become a geopolitical flashpoint. From chip shortages to supply chain reshoring, governments worldwide are pouring billions into ensuring domestic production strength.

One of the biggest beneficiaries of this push is Intel (INTC), which just secured $5.7 billion in cash from the U.S. government in exchange for a 10% ownership stake. According to Intel CFO David Zinsner, the deal is aimed at funding the company’s foundry ambitions, with the White House calling the details still a “work in progress.” For Intel, this injection of capital is more than just balance sheet support; it’s a chance to prove its manufacturing edge at a time when rivals like Taiwan Semiconductor (TSM) and Samsung dominate.

With political backing, fresh capital, and ambitious foundry goals, the big question now is whether investors should buy INTC stock. Let's find out.

About INTC Stock

Based in California, Intel is a global leader in designing and manufacturing semiconductor products. Through its Products and Foundry segments, it develops CPUs, GPUs, AI accelerators, and edge solutions, serving OEMs, cloud providers, and enterprises driving digital transformation across computing, networking, and AI environments.

Valued at around $106 billion by market cap, INTC stock rallied steadily in 2025, up roughly 21% YTD as investors priced in government support and restructuring hopes. A $5.7 billion U.S. infusion, aggressive cost cuts, and renewed foundry focus bolstered sentiment.

INTC's valuation appears pretty attractive at the current price point. Its price-to-book (P/B) ratio of 1.05 is significantly lower than the sector median of 4.55, indicating the stock is undervalued compared to its peers. Additionally, its price-to-sales (P/S) ratio of 2.03 is 40% cheaper than the sector median, suggesting a discount on sales valuation.

What Does Intel’s Government Stake Mean for Investors?

Intel became the focus of Wall Street after the Trump administration took a 10% stake in the chipmaker. While the move signals strong government interest in Intel’s role as a strategic technology player, it has also raised questions about what this ownership really means for investors.

Government stakes in private firms are unusual in the U.S., typically reserved for bailouts during crises. Intel, however, is not in financial distress. Instead, analysts believe the deal reflects Washington’s push to secure domestic semiconductor leadership and protect supply chains.

Supporters argue the partnership could lower Intel’s borrowing costs, bring favorable regulations, and give the firm political tailwinds as it expands foundry operations in the U.S. However, critics warn that government involvement may lead to inefficiencies, slower innovation, and decisions based more on political goals than shareholder returns, similar to experiences at state-influenced companies abroad, such as Volkswagen (VWAGY).

For now, investors seem optimistic that federal backing will boost Intel in the short term. However, the long-term outlook depends on Intel’s ability to deliver competitive products and maintain efficiency without leaning too heavily on political support.

Intel Beats Q2 Earnings Estimate

Intel’s second-quarter 2025 results came in slightly ahead of expectations, marking a rare positive inflection after several quarters of uneven performance. Revenue reached $12.9 billion, beating Wall Street’s forecast of $11.9 billion and posting the first year-over-year (YoY) increase since Q1 2024. Sequentially, sales rose 1.5%, driven mainly by strength in the Client Computing Group, which benefitted from tariff-driven demand shifts.

Net income, however, reflected the weight of restructuring efforts. Intel booked a $1.9 billion charge tied to a planned 15% workforce reduction, along with another $1 billion impairment on manufacturing equipment. These charges pushed reported earnings sharply lower. Adjusted EPS landed well below consensus at a loss of $26, pressured by the one-offs, though management stressed that core operating trends remained intact.

Free cash flow slipped modestly, while Intel still exited the quarter with a solid cash balance north of $24 billion, providing flexibility for ongoing foundry investments.

Looking ahead, Intel guided for Q3 revenue between $12.5 billion and $13.5 billion with adjusted EPS in the $0.10 to $0.15 range, reflecting continued restructuring costs. For full-year 2025, the company reaffirmed expectations of flat-to-low single-digit revenue growth, while analysts currently model $51.8 billion in sales and $0.62 EPS.

What Do Analysts Think About INTC Stock?

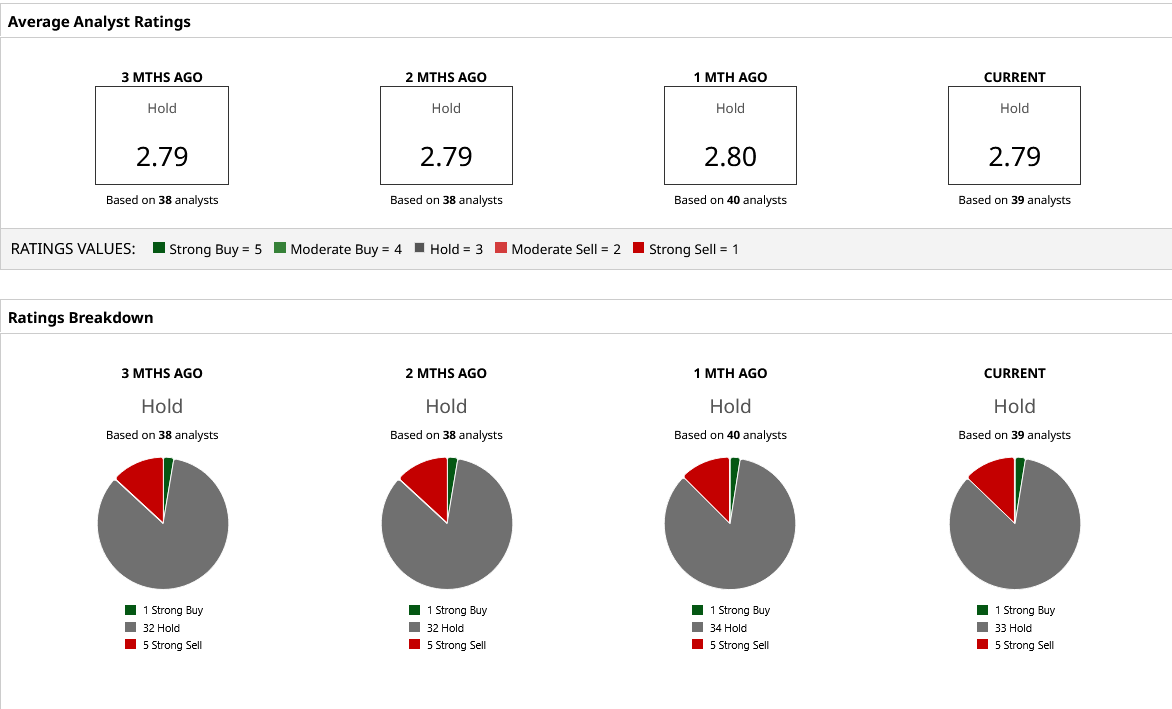

Wall Street analysts have taken a cautious stand despite the $5.7 billion government deal. The group of 39 analysts covered by Barchart has given a consensus "Hold" rating to INTC stock. The stock has already surpassed the mean price target of $21 and is heading to the street high of $28, which is also around 16% up from here.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.