Spotify Is Launching In-App Messaging. Will That Change the Game for SPOT Stock?

/Spotify%20logo%20by%20Bastian%20Riccardi%20via%20Unsplash.jpg)

Spotify (SPOT) is one of the unique tech stocks that's seen some impressive growth over the past year. And given the strength of the overall market rally of late, it shouldn't be surprising to many to note that this rally has led to about 100% gains for the stock over the past year, at the time of writing.

The audio streaming platform has continued to see strong growth, driven by a pivot toward podcasts and music streaming services. Spotify's bundled packages, which include a number of intriguing add-ons, have driven more and more users to the platform.

However, a recent announcement that Spotify will be introducing a new direct messaging feature has some investors even more giddy on the stock. Let's dive more into what was announced and what this may mean for Spotify moving forward.

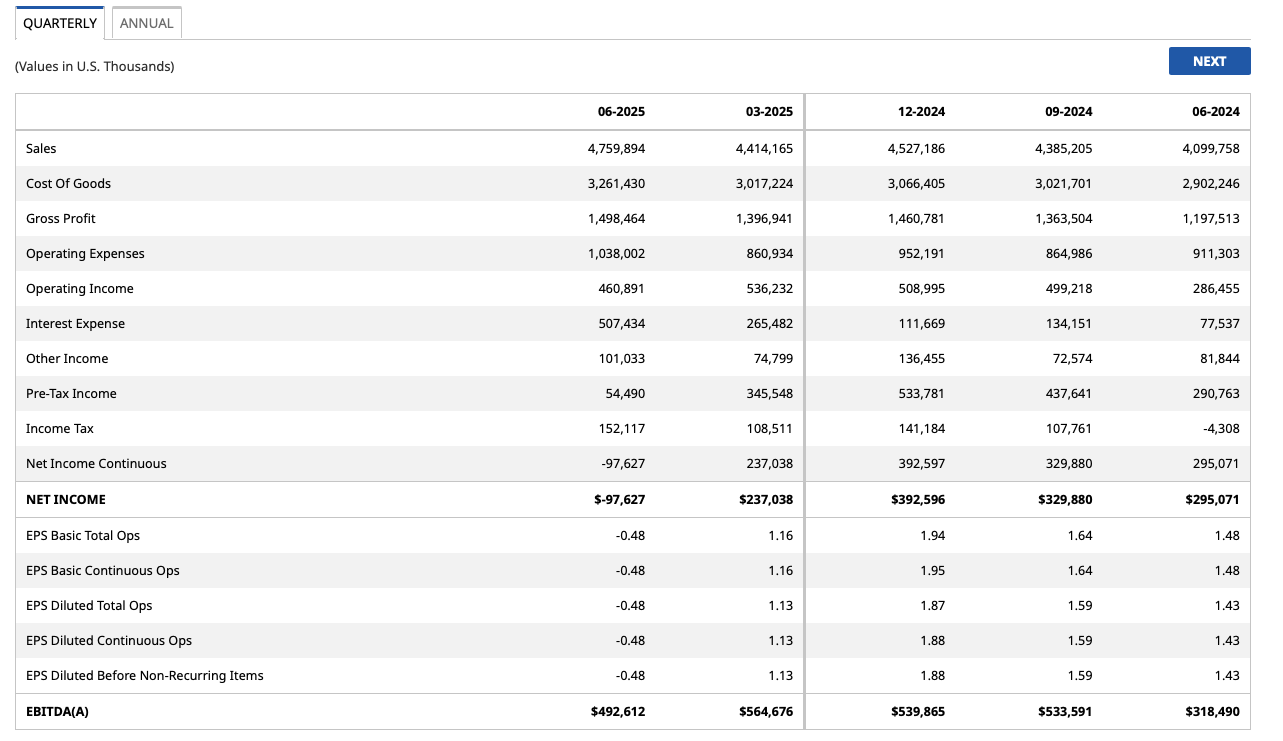

Spotify's Strong Fundamental Picture

One of the key factors that can get lost during rabid bull market rallies, such as the one we've been in for some time now, is valuation. Valuation matters, and that's always true. But when investors are willing to pay higher and higher prices for growth, that's when some investors may choose to opt for more conservative portfolio construction.

The thing is, while Shopify's underlying growth remains strong (around 16% revenue growth year-over-year), overall EBITDA growth has slowed. Accordingly, while adding more paying customers is always a good thing, adding more in the way of costs as a company scales isn't generally perceived to be a good thing.

That said, this recent announcement that DMs will become part of Spotify's offerings is intriguing. This move has the potential to position Spotify as a leader in the social media space, with a devoted base of music lovers (and casual listeners) bantering back and forth about almost anything.

Notably, this feature is expected to be rolled out to both free and premium users, so it does appear that Spotify is looking to cast a large net. With what appears to be solid encryption technology underpinning this release, and millions of paying subscribers looking to connect over music, this integration is one that certainly seems to make sense.

We'll have to see whether adding DMs will really change the game for music aficionados and artists (or if some functionality will be included later to allow musicians to reach their fans). But with new tools comes plenty of speculation, and right now the market appears to be taking this news in a positive light.

I think some investors may want to see earnings come back into the black before jumping in, and that's fair. But Spotify is a company with an entrenched moat and one that does appear to be growing meaningfully—if a push for efficiency can boost growth, that's a good thing for investors over the long term.

What Do Analysts Think About SPOT Stock?

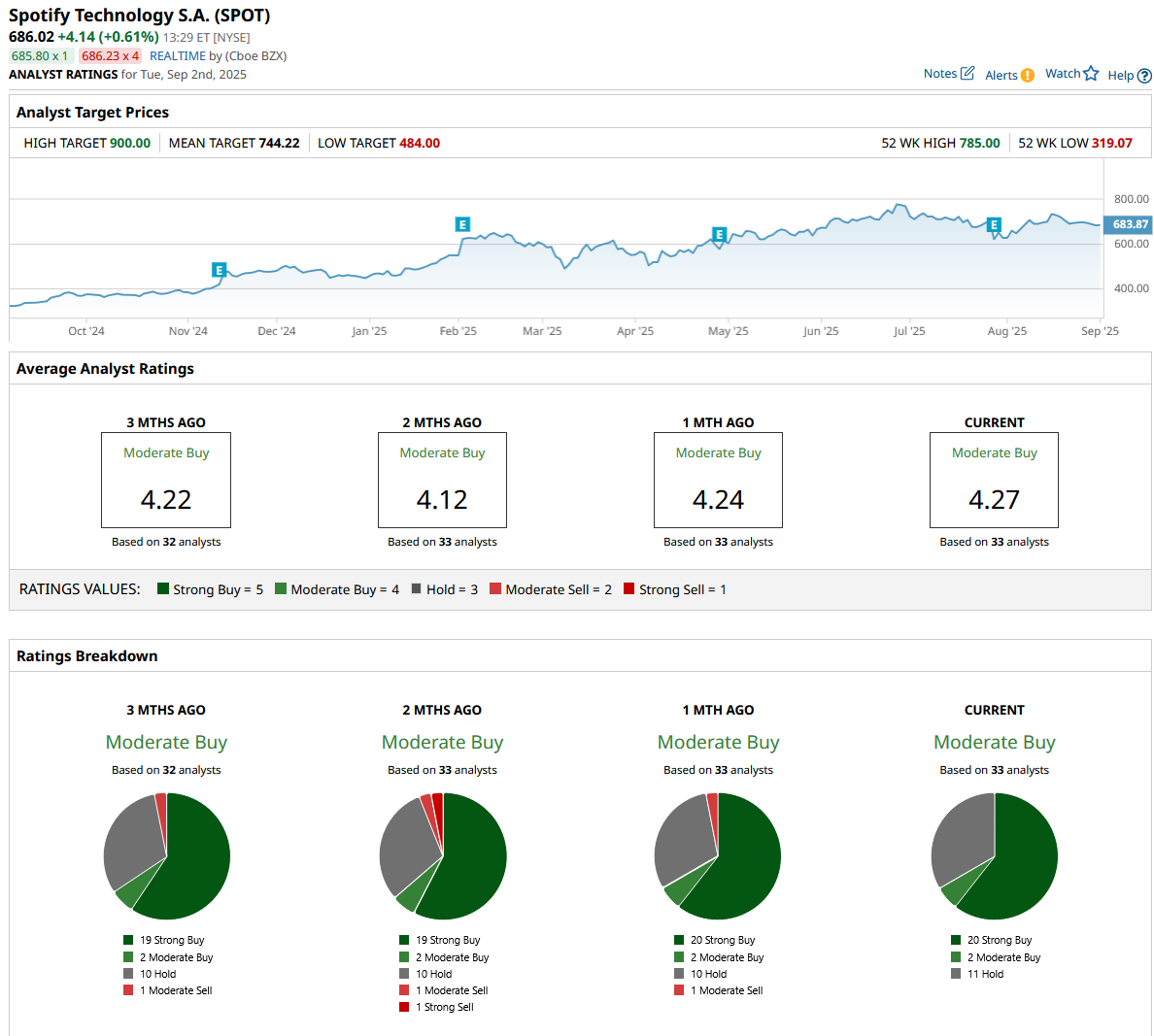

Wall Street analysts have SPOT stock pegged as a consensus “Moderate Buy,” and I think that's a fair assessment of where this stock stands in terms of its upside potential relative to its valuation.

It's important to remember that SPOT stock has doubled over the past year, so plenty of future growth is already priced into the company's valuation. But if future product improvements and feature releases embolden the company's user base to listen more (and take in more ads), this scalable model could really take off. That's a bet that appears to remain favorable for investors, with the consensus price target of $744.22 per share implying around 9% upside from here.

Of course, some analysts are very bullish on SPOT stock and think this is a tech stock that could have more than 30% upside from here (with a low target implying downside potential of around the same amount). We'll have to see how things play out. But for now, I think Wall Street analysts have this stock correctly pegged.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.