Customers Don’t Like Tesla’s FSD. Should You Hit the Brakes on TSLA Stock in September 2025?

/Tesla%20charging%20station%20black%20background%20by%20Blomst%20via%20Pixabay.jpg)

Tesla (TSLA) has long led the charge at the intersection of electric cars and artificial intelligence (AI) but is raising new concerns in its current hype around Full Self-Driving (FSD). A recent consumer sentiment survey finds that rather than creating new demand, Tesla's product in FSD could be pushing demand in the opposite direction.

These comments occur at a time when Tesla itself faces a broader identity crisis. Once clearly ahead of the EV curve, the company is fighting against declining global sales growth, a rising BYD (BYDDY) and other traditional automaker challenges, as well as now increasing questions about its autonomous vehicle roadmap. With sales in Europe crashing and brand image below that of a year ago, September 2025 could be a turning-point month for TSLA stock.

About Tesla Stock

Tesla is headquartered in Austin, Texas. It works in automotive and energy business divisions and manufactures electric vehicles, energy storage products, solar products, and software-based AI. It still has a market cap above a trillion dollars but has a growth story becoming dependent on how successful its FSD project and energy business become instead of car sales.

TSLA stock has fluctuated between $209.64 and $488.54 over the past 52 weeks, an indication of intense volatility with sentiment fluctuating about Tesla’s vision of innovation. That disappointing performance compares unfavorably to this year’s approximately 17% gain in the S&P 500 ($SPX) and highlights Tesla's struggles in this market environment.

Tesla continues to deserve a premium valuation on nearly any basis. Its forward price-earnings (P/E) multiple of 277x is quite high compared to both sector multiples and most technology mega-cap peers. It sells at a price-to-sales (P/S) and a price-to-cash flow of 11.6x and 86.2x, respectively. While Wall Street has long embraced multiples based on Tesla's innovation opportunity, recent financial numbers raise doubt about whether that premium still makes sense.

Tesla does not pay a dividend but rather invests intensively in facilities to train AIs, new model development, and overseas manufacturing capacity. While this long-term plan will eventually return to shareholders in dividends, volatility in the immediate term still hangs large.

Tesla Disappoints on Earnings Despite Robotaxi Rollout

Tesla's Q2 2025 results reflected a company in flux. Diluted GAAP EPS was $0.33, down 18% year-on-year. Non-GAAP EPS was down 23% year-on-year (YoY) to $0.40. Revenue was $22.5 billion, down 12% because of fewer vehicle deliveries, a decline in average sale prices, and a sharp decline in regulatory credit sales.

Automotive revenues came in at $16.66 billion, and energy generation and storage brought in $2.79 billion, down 7% compared to a year ago. Services and Other was the only growth area, climbing 17% to $3.05 billion, driven in part by improved Supercharger monetization and new software-based services.

Operating income fell to $923 million, a 42% decline versus last year, generating a slim 4.1% operating margin. Quarter-end free cash flow dropped to a paltry $146 million, an 89% decline versus Q2 2024, due to higher CapEx and a decline in vehicle production efficiency. Tesla continues to invest aggressively in robotaxi development, neural net model training facilities, and new vehicle architecture, the future Cybercab and mass-market Model Y variant.

One of the quarter's large metrics was a small Austin deployment of Tesla's robotaxi system. While still in supervised testing phases, Tesla completed its first autonomous delivery of a Model Y directly to a customer's front door, a symbolic but preliminary step in Musk's long-promised robotaxi revolution.

It didn't issue formal Q3 EPS or revenue guidance and has no fixed date scheduled for a follow-up earnings call. But management reiterated that it's keeping to plan on scaling autonomy, progressing its energy business, and keeping a strong balance sheet while operating against global macro uncertainty.

What Do Analysts Forecast About TSLA Stock?

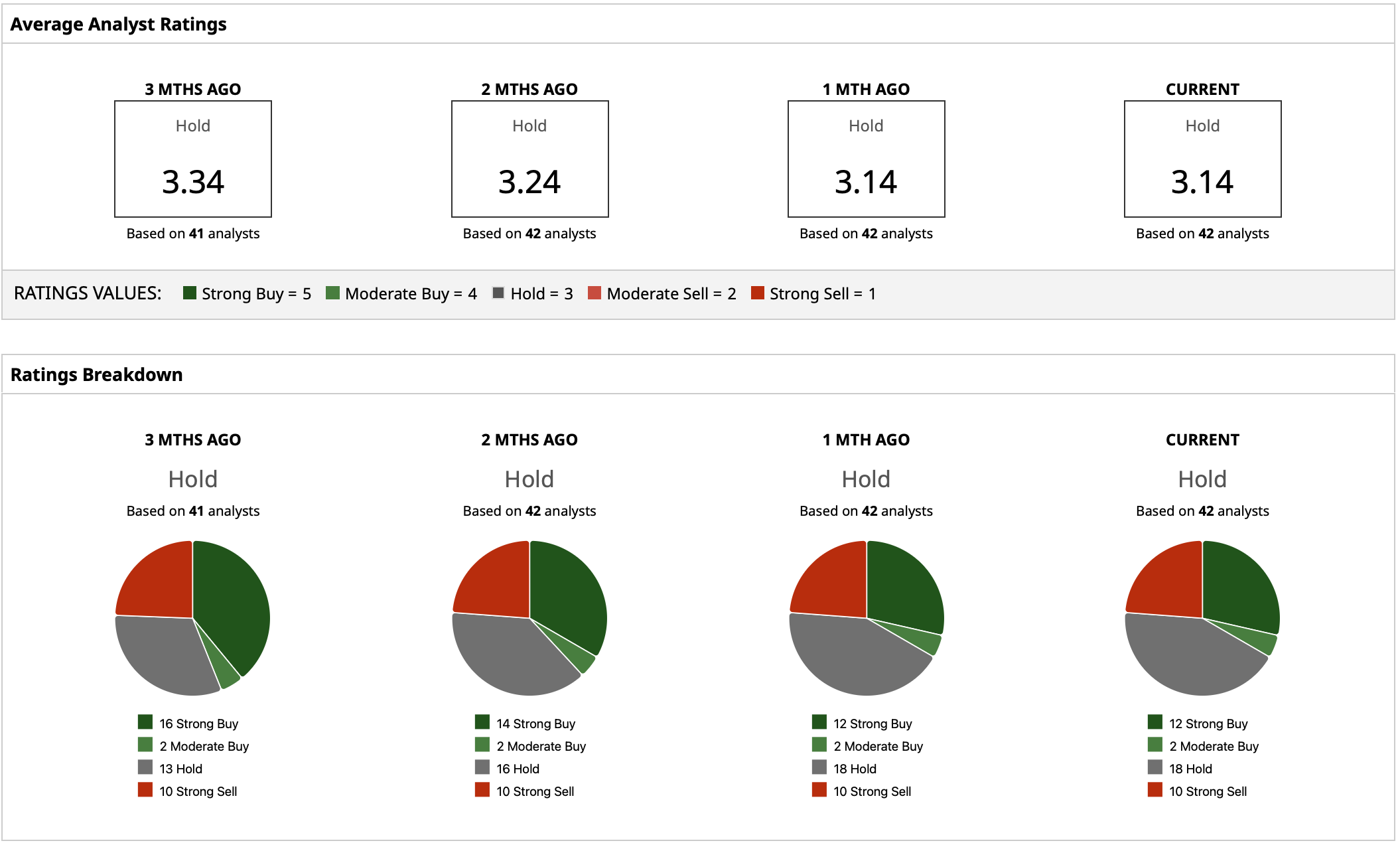

Wall Street is becoming increasingly divisive about Tesla's future. It's covered by 42 analysts who have a consensus “Hold” rating. It has 12 Strong Buys, two Moderate Buys, 18 Holds, and 10 Strong Sells; this again emphasizes a split between bulls and bears on Tesla.

Tesla's consensus target is $299.28, a 9% increase below current levels. While bulls remain enthusiastic about Tesla's software and AI stack having long-term margin expansion possibilities, current numbers suggest these initiatives still have a long way to go in generating a material level of profitability. Robotaxi service still remains in early development stages, while Full Self-Driving continues facing regulatory, legal, and consumer trust obstacles.

On the date of publication, Yiannis Zourmpanos had a position in: TSLA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.