Up More Than 50% in 6 Months, Can This Safe Dividend Stock Rally Any Further?

Gold has been the ultimate and relatively safe bet among the various “Trump trades.” While President Donald Trump’s policies have been negative for companies that rely on imports, the tariff uncertainty has invariably been a boon for gold.

The precious metal has outperformed broader markets in 2025, with the SPDR Gold Trust ETF (GLD) up over 33% for the year. Gold mining companies, which tend to rise or fall more than gold prices, have also delivered stellar returns, and the VanEck Gold Miners ETF (GDX) has gained over 90% this year.

Gold mining companies are experiencing a rally of a lifetime, thanks to the record or near-record cash flows they are generating. Companies have used these bumper cash flows to deleverage their balance sheets and increase shareholder payouts through dividends and buybacks.

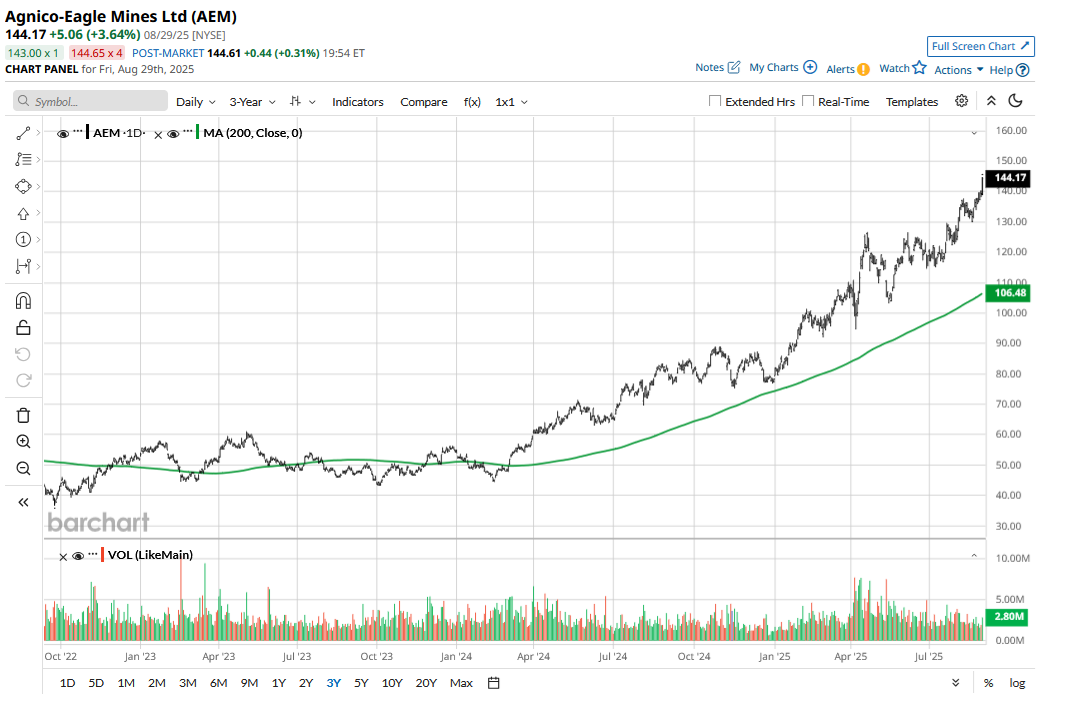

Among gold mining companies, Agnico-Eagle Mines (AEM) is a safe bet, given its strong balance sheet, low-cost operations, and robust mineral reserves. It has a long track record of paying dividends, and looking at the strength in gold prices, investors can expect more gains in the coming months after the 50% rally in the previous 6 months.

Gold Price Forecast: Can Gold Prices Hit $4,000?

Most brokerages are bullish on gold and expect the yellow metal to continue its upward trajectory. UBS recently raised its gold price forecast and now sees prices rising to $3,600 per ounce in Q1 2026, $100 higher than its previous forecast. The brokerage also raised its forecast for Q2 2026 and Q3 2026 to $3,700 per ounce.

JPMorgan expects prices to average $3,675 per ounce in Q4 2025 and predicts them hitting $4,000 in Q2 2026. Citi, which had lowered its gold price forecast in June, also made a U-turn and raised its forecast last month.

Looking at the tariff turmoil, geopolitical uncertainty, investment demand (including from ETFs), and the de-dollarization drive among central banks, gold’s outlook looks bullish over the medium to long term. In the short term, global monetary policy easing, including what looks like an imminent Federal Reserve rate cut, is a positive for gold.

Trump’s relentless tirade against the Fed can also support gold’s rally. Central bank independence is a hallmark of all modern economies, and any signs to the contrary are negative for markets and Treasuries, while being a positive for gold.

I have been bullish on gold for the last couple of years, and the outlook has only been getting brighter given the macro and geopolitical developments.

What Makes AEM a Safe Gold Stock

AEM is one of the largest gold mining companies globally, with mines in “safe” jurisdictions in Canada, Mexico, Australia, and Finland, with Canada accounting for a lion’s share of its production as well as reserves. Notably, markets allot a premium to companies that have their mining assets in safer jurisdictions, and the trend is only expected to gain traction amid calls for resource nationalization in some regions.

AEM is in the second quartile of the global cost curve. Its all-in sustaining costs (AISC) were $1,279 per troy ounce in Q2, and management reaffirmed the 2025 guidance of between $1,250-$1300 per troy ounce.

Finally, AEM has an impeccable balance sheet and had a net cash position of nearly $1 billion at the end of June. The company still has a gross debt of around $600 million and is looking to further deleverage its balance sheet in the back half of the year. Having a strong balance sheet would help AEM survive any unforeseen weakness in gold prices.

Agnico-Eagle Mines’ Dividend Policy

Agnico-Eagle Mines aims to return around a third of its free cash flows to shareholders in the form of dividends and share repurchases. The company has paid dividends for 42 consecutive years, and the bonanza is expected to continue as higher gold prices lead to an increase in earnings. In Q2 2025, Agnico-Eagle Mines generated free cash flows of $1.3 billion, of which it used $200 million for dividends and another $100 million for share repurchases.

AEM's current dividend yield stands at 1.1%. While management said that it would prioritize share buybacks in the back half of the year, it talked about the possibility of increasing the dividend either later this year or early next year. Given the positive fundamentals of gold prices, I expect the company to raise its dividends sooner rather than later.

AEM Stock Forecast

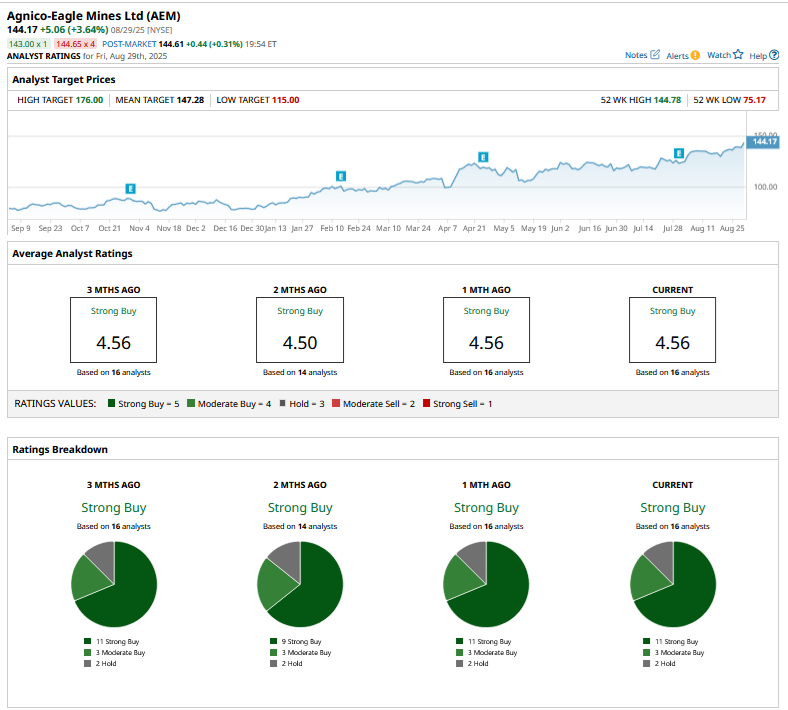

Of the 16 analysts covering AEM, 11 rate it as a “Strong Buy” while 3 as a “Moderate Buy.” The remaining 2 rate the stock as “Hold” or some equivalent. Sell-side analysts have been gradually raising AEM’s target price to catch up with the price action, and the current mean target price stands at $147.28, which is only marginally higher than current price levels.

On the date of publication, Mohit Oberoi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.