Amphenol Stock: Is APH Outperforming the Technology Sector?

/Amphenol%20Corp_%20phone%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $133.4 billion, Amphenol Corporation (APH) is a leading global designer, manufacturer, and marketer of electrical, electronic, fiber optic connectors, interconnect systems, antennas, sensors, and specialty cables. Amphenol operates worldwide through its three business segments: Harsh Environment Solutions, Communications Solutions, and Interconnect and Sensor Systems.

Companies valued at more than $10 billion are generally considered “large-cap” stocks, and Amphenol fits this criterion perfectly. With vertically integrated operations spanning from initial design through final manufacturing, the company serves diverse markets including automotive, aerospace, industrial, IT/datacom, military, mobile devices, and communications.

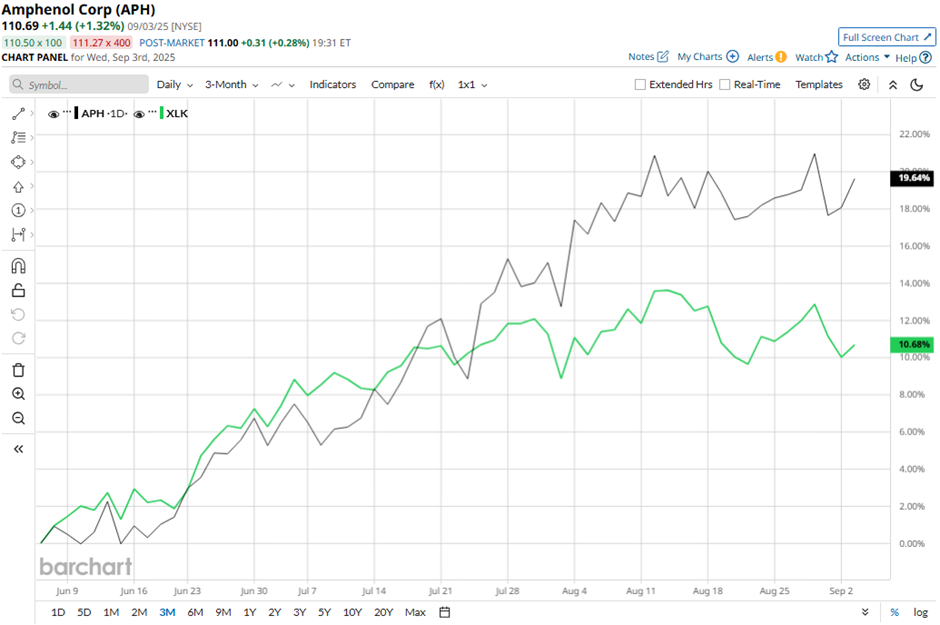

However, shares of the Wallingford, Connecticut-based company have dipped 1.5% from its 52-week high of $112.35. Over the past three months, APH stock has increased 20.7%, which outpaced the Technology Select Sector SPDR Fund's (XLK) rise of 10.5% during the same period.

In the longer term, shares of the fiber-optic products maker have jumped 59.4% on a YTD basis, outperforming XLK’s 12.4% return. Moreover, shares of Amphenol have climbed 78.8% over the past 52 weeks, compared to XLK’s 24.3% gain over the same time frame.

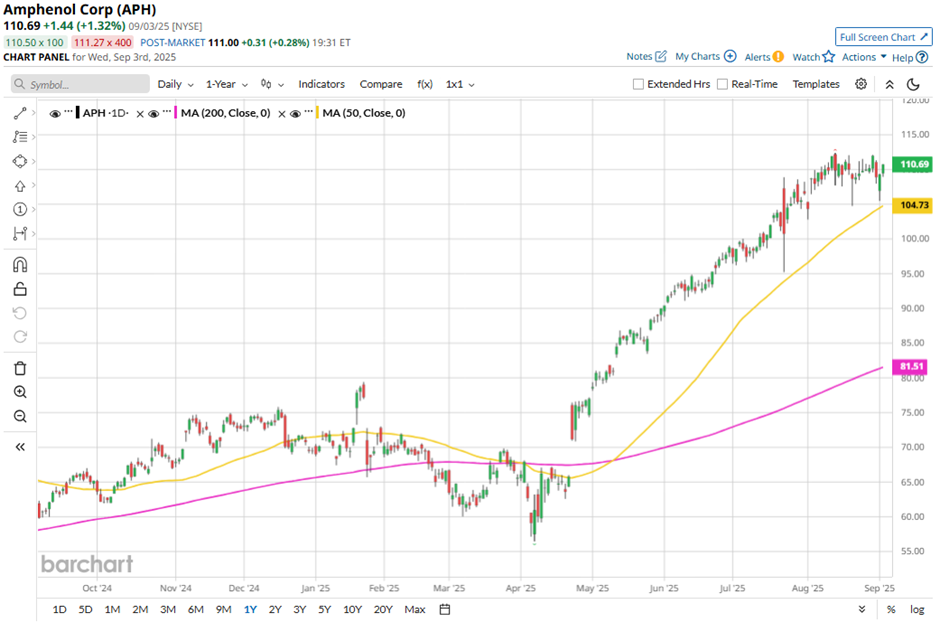

APH stock has been trading above its 50-day and 200-day moving averages since late April.

Shares of Amphenol rose 3.7% following its Q2 2025 results on Jul. 23. Adjusted EPS came in at $0.81 and revenue reached $5.7 billion, ahead of forecasts. Investor optimism was further boosted by the company’s Q3 outlook, projecting revenue of $5.4 billion - $5.5 billion and adjusted EPS of $0.77 - $0.79. Additionally, demand was especially strong in the Communications Solutions segment, where sales surged to $2.9 billion, more than doubling from a year ago, signaling momentum from tech and defense investments in AI and computing infrastructure.

In comparison, rival TE Connectivity plc (TEL) has lagged behind APH stock. TEL stock has surged 44.1% on a YTD basis and 38.8% over the past 52 weeks.

Due to APH’s strong performance, analysts are bullish about its prospects. The stock has a consensus rating of “Strong Buy” from the 17 analysts in coverage, and the mean price target of $117.47 is a premium of 6.1% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.