Trane Technologies Stock: Is TT Outperforming the Industrial Sector?

/Trane%20Technologies%20plc%20logo%20and%20price%20data-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Swords, Ireland-based Trane Technologies plc (TT) designs, manufactures, sells, and services industrial equipment. With a market cap of $91.4 billion, the company offers central heaters, air conditioners, electric vehicles, air cleaners, and fluid handling products.

Companies worth $10 billion or more are generally described as “large-cap stocks.” TT effortlessly fits that bill, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the Building Products & Equipment industry. TT’s strong brand presence and commitment to innovation are central to its market success. The company's reputable Trane and Thermo King brands are synonymous with quality and reliability in the HVAC and transportation refrigeration industries. This reputation is underpinned by a consistent focus on research and development, leading to a portfolio of patented technologies and solutions that address the evolving needs of energy efficiency and sustainability.

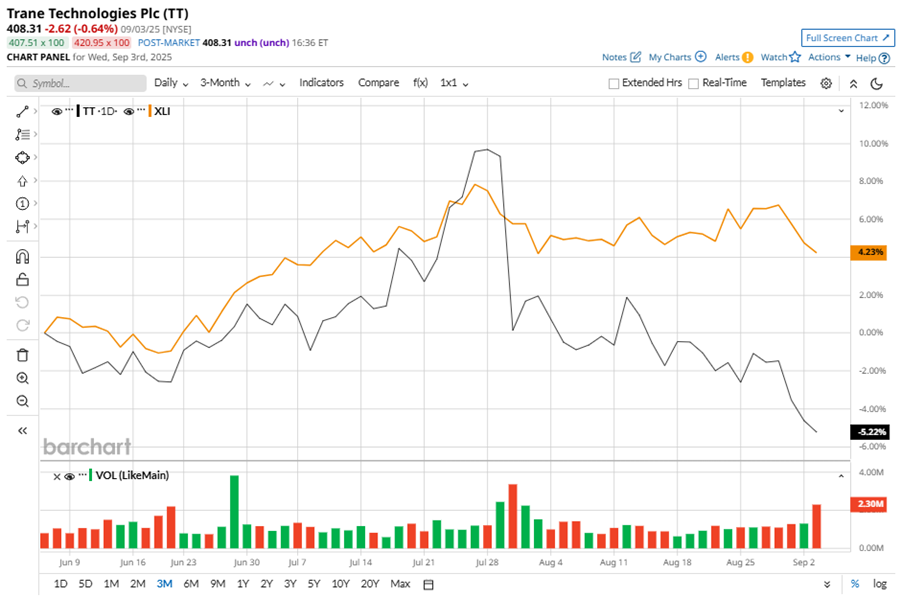

Despite its notable strength, TT slipped 14.3% from its 52-week high of $476.19, achieved on Jul. 28. Over the past three months, TT stock has declined 5.7%, underperforming the Industrial Select Sector SPDR Fund’s (XLI) 4.2% gains during the same time frame.

In the longer term, shares of TT rose 10.6% on a YTD basis, underperforming XLI’s YTD gains of 13.7%. However, the stock climbed 18% over the past 52 weeks, outperforming XLI’s 16.5% returns over the same time frame.

To confirm the bullish trend, TT has been trading above its 200-day moving average since late April. However, it is trading below its 50-day moving average since late July, with slight fluctuations.

Trane Technologies is outperforming due to the growing demand for sustainable solutions that reduce energy consumption, emissions, and operational costs. The company's recent acquisition of BrainBox AI and establishment of the BrainBox AI Lab are driving innovation in AI-powered building solutions, enabling more innovative energy use and digital transformation.

On Jul. 30, TT shares closed down more than 8% after reporting its Q2 results. Its revenue stood at $5.7 billion, up 8.3% year-over-year. The company’s adjusted EPS increased 17.6% from the year-ago quarter to $3.88.

TT’s rival, Carrier Global Corporation (CARR) shares lagged behind the stock, with an 8.5% downtick on a YTD basis and a 10.8% dip over the past 52 weeks.

Wall Street analysts are reasonably bullish on TT’s prospects. The stock has a consensus “Moderate Buy” rating from the 21 analysts covering it, and the mean price target of $468.53 suggests a potential upside of 14.7% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.