Is Sherwin-Williams Stock Underperforming the Dow?

With a market cap of $91.1 billion, The Sherwin-Williams Company (SHW) is a leading global manufacturer and distributor of paints, coatings, and related products. Founded in 1866 and headquartered in Cleveland, Ohio, the company serves professional, industrial, commercial, and retail customers.

Companies worth $10 billion or more are generally described as “large-cap stock,” Sherwin-Williams fits this bill perfectly. It operates through three main segments: The Americas Group, which manages its extensive paint store network across North and South America; Consumer Brands Group, which provides branded and private-label products through major retailers; and Performance Coatings Group, which delivers industrial coatings worldwide. The company’s global presence, substantial brand equity, innovation in coatings, and expansive distribution network position it as a leader in the industry.

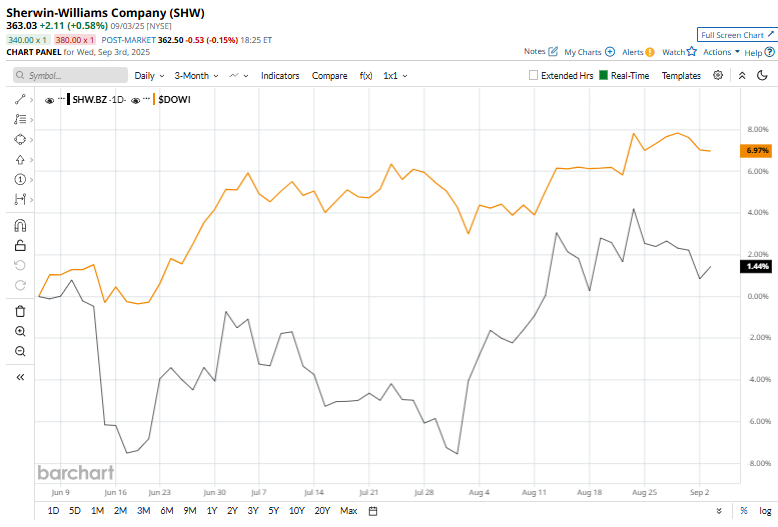

SHW stock touched its 52-week high of $400.42 on Nov. 27, 2024, and is currently trading 9.3% below that peak. Over the past three months, SHW has surged 1.5%, lagging behind the broader Dow Jones Industrial Average’s ($DOWI) 6.5% rise during the same time frame.

SHW has dipped marginally over the past 52 weeks, notably underperforming $DOWI’s 10.6% surge over the past year. But, in 2025, SHW is up 6.8%, slightly outpacing $DOWI’s 6.4% gains on a YTD basis.

SHW shares have been trading above both its 50-day and 200-day moving averages since early August, indicating a recent uptrend.

On Jul. 22, Sherwin-Williams shares dropped marginally after releasing its second-quarter earnings. The company reported marginal year-over-year sales growth to $6.31 billion, but profits fell sharply, with adjusted EPS down 8.6% to $3.38, missing estimates. The quarter also saw $59 million in restructuring charges and $40 million in building-related costs, prompting the company to lower its full-year adjusted EPS guidance to $11.20–$11.50 and forecast flat to low-single-digit sales change.

Sherwin-Williams has notably outperformed its competitor, PPG Industries, Inc.’s (PPG) 14.7% drop in stock prices over the past 52 weeks and an 8.6% decline on a YTD basis.

Among the 28 analysts covering the SHW stock, the consensus rating is a “Moderate Buy.” Its mean price target of $384.09 suggests a 5.8% upside from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.