This Penny Stock Is Soaring on a New NATO Defense Play. Should You Buy Shares Here?

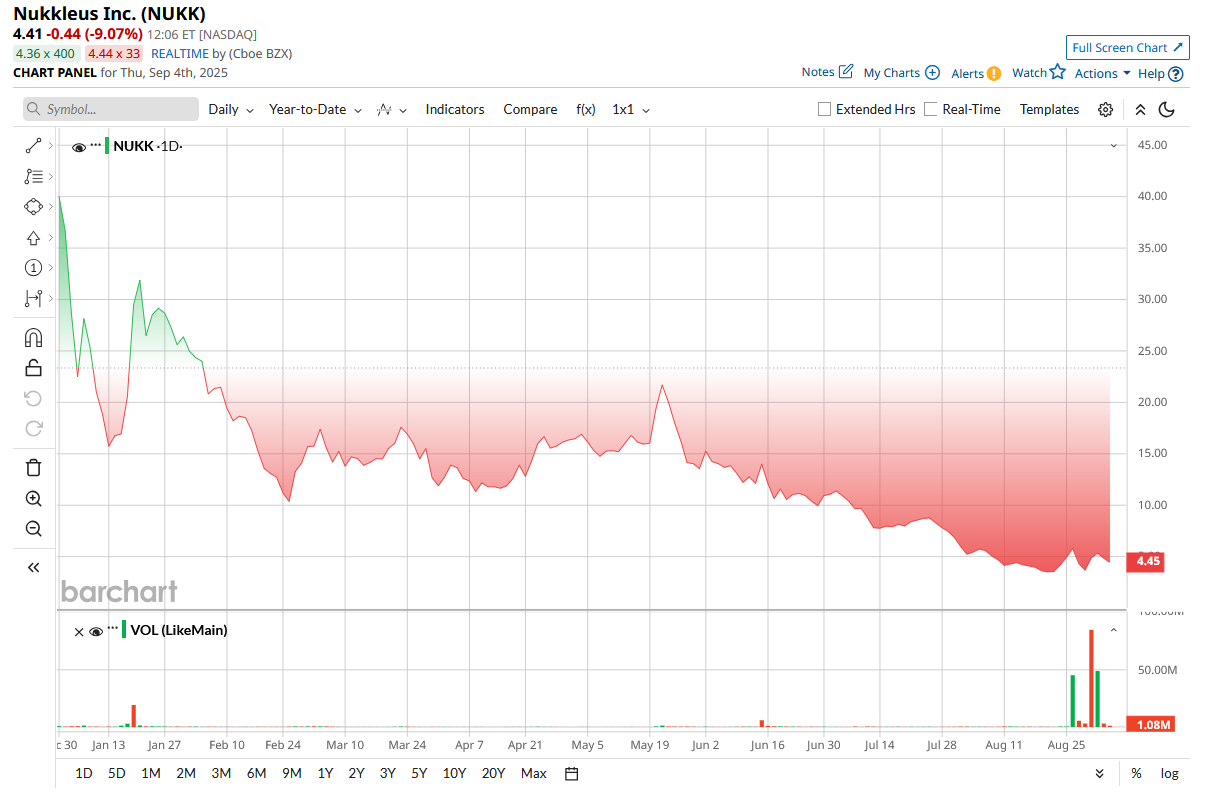

Nukkleus (NUKK) stock surged approximately 30% last Friday after announcing a strategic joint venture with Israeli aerospace and defense investment firm Mandragola. The partnership aims to establish a NATO-compliant logistics hub in Riga, Latvia, targeting the Baltic States amid heightened geopolitical tensions from the ongoing Russia-Ukraine war.

The venture will focus on commercial and defense-oriented infrastructure modernization, capitalizing on the growing global aircraft Maintenance, Repair, and Overhaul market projected to reach $124 billion by 2034.

"This joint venture aligns with Nukkleus' mission to grow high-impact businesses in strategic sectors," said CEO Menny Shalom, emphasizing the platform's capability to service both commercial and defense applications.

The collaboration plans to establish advanced manufacturing zones in the Baltics and Israel while identifying early-stage Israeli technology companies for potential investment. Experienced aviation professionals, including former Israeli Air Force pilots, will guide the initiative.

A 360-Degree Pivot for Nukkleus

Nukkleus has undergone a notable transformation from a fintech company to a defense contractor. In January 2024, Nukkleus terminated existing customer and supplier contracts and shifted focus to payment services. By November, it entered a settlement agreement to sell its payment services subsidiary for just £1,000 (approximately $1,372), pending shareholder approval.

The company's pivot from foreign exchange trading technology to defense and aerospace represents a complete overhaul of its business model. Nukkleus is positioning itself as an acquirer of Tier 2 and Tier 3 defense suppliers, which target the industrial backbone of national security infrastructure across the U.S. and Israel.

The pending acquisition of Star 26 Capital, which specializes in Iron Dome generator systems, marks a crucial step in this transformation. Combined with subsidiary Rimon's tactical vehicle outfitting capabilities and the recent NATO-aligned joint venture with Mandragola, Nukkleus is building a diversified defense portfolio.

However, investors should carefully weigh its strategic potential against financial headwinds. It ended the June quarter with only $1.52 million in cash and a working capital deficit of $53.4 million. Nukkleus faces substantial doubt about its ability to continue operations without additional financing, as it burned through nearly $3 million in operating cash flow during the first half of 2025.

Management acknowledges that future financing "likely would be dilutive to existing stockholders" and could impose restrictive covenants that negatively impact business operations.

Understanding Penny Stock Risks and Rewards

Nukkleus exemplifies the potential and perils of penny stock investing. Companies trading below $5 per share often present compelling growth narratives but carry disproportionate risks that can devastate portfolios.

The rewards can be substantial when penny stocks execute successful turnarounds or benefit from industry tailwinds. Defense contractors have historically outperformed during periods of geopolitical tension, and NATO's increased focus on Baltic security creates market opportunities.

However, penny stocks frequently suffer from limited liquidity, making it difficult to exit positions quickly. They also face higher bankruptcy risks due to weak balance sheets and restricted access to capital markets. Nukkleus's financial position exemplifies these challenges, with its survival dependent on securing external funding that may not materialize on acceptable terms.

Additionally, penny stocks are often subject to greater volatility and manipulation, making them unsuitable for risk-averse investors or those seeking stable returns. While Nukkleus operates in attractive defense markets with growing geopolitical demand, its precarious financial position and dependence on external financing make it a high-risk proposition.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.