Is Platinum Going to Catch Gold?

Years ago, platinum’s nickname was “rich person’s gold,” as the rare precious metal commanded a premium to the yellow metal. I asked if platinum’s rally would continue and if it could become rich person’s gold again in a late-July Barchart article on the platinum market, when I concluded:

Platinum remains in a bullish trend, with plenty of upside room before it approaches the 2008 all-time high. Given gold’s ascent over the past years and platinum’s liquidity constraints, platinum could head back to its former position as “rich person’s gold.”

Nearby NYMEX platinum futures were trading at $1,422.90 on July 28. The $1460 level in early September could be a golden buying opportunity.

Platinum corrects lower

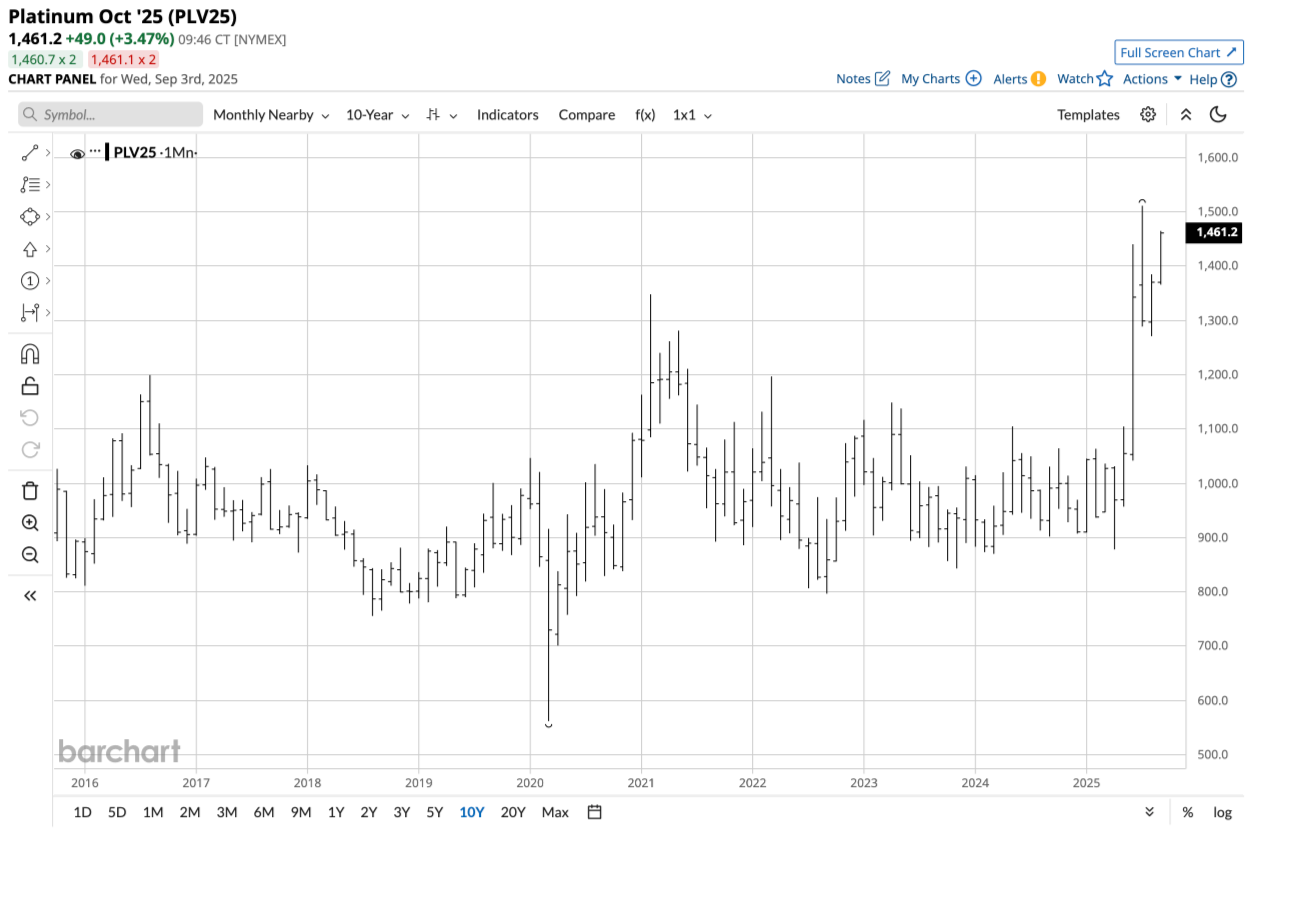

The quarterly chart highlights that after trading around a $1,000 per ounce pivot point for nearly a decade from Q3 2015 through Q1 2025, NYMEX platinum broke out to the upside.

Platinum futures eclipsed the critical technical resistance at the Q1 2021 high of $1,348.20 in Q2 2025. Moreover, the platinum futures formed a bullish key reversal pattern on the quarterly chart in Q2 2025, trading below the Q1 2025 low and closing above the high of the previous quarter. After trading to a peak of $1,440.50 in Q2 2025, platinum futures reached a higher high of $1,511.40 in Q3 where they ran out of upside steam, falling to the $1,270 level in August before recovering to around $1,460 in early September 2025.

The bullish trend remains intact

The shorter-term monthly continuous platinum futures chart highlights the bullish trend that has taken the rare precious metal to a new decade high.

The chart highlights the bullish trend, despite the pullback from the July high of over $1,500 per ounce.

The daily year-to-date chart displays an even more dramatically bullish picture for the platinum futures.

Even the most aggressive bull markets rarely move in straight lines

The nearby NYMEX platinum futures rallied 72%, moving from an April 7, 2025, low of $878.30 to a July 21, 2025, high of $1,511.40 per ounce. While the price has corrected, even the most aggressive trends can experience substantial corrections. Technical support for the NYMEX platinum futures remains far below the current $1,340 level, with the support at the late May 2025 high of just over $1,100 per ounce. Buying platinum during the current correction could be optimal as the precious metal remains in a compelling bullish trend.

Factors supporting higher platinum prices- The platinum-gold differential

The following factors support higher platinum prices:

- After consolidating around the $1,000 per ounce pivot point for nearly a decade, platinum futures broke out to the upside and remain in a bullish trend in early September 2025.

- Platinum is a rare metal, with only around seven million ounces or 218 metric tons of annual mine supply in 2025. South Africa is the leading producer, while Russia and Zimbabwe are second and third. The three countries accounted for approximately 75% of platinum output in 2023.

- In Q1 2025, the World Platinum Investment Council forecasted a third consecutive year for a substantial deficit in platinum’s supply-demand equation. The tight platinum market is a result of declining mine supplies.

- Gold has reached a record high over the past eight consecutive quarters, and silver prices have increased to the highest level since 2011. Platinum, like gold and silver, has industrial and financial applications, favoring higher platinum prices.

- Platinum is a far less liquid futures market than gold and silver. In early September, the open interest in NYMEX platinum futures was 88,805 contracts, representing 4.44 million ounces. At $1,460 per ounce, the total value of the platinum futures market was $6.483 billion. The total values of the gold and silver futures market were over $178.6 billion and over $33 billion, respectively. Platinum is a smaller and less liquid futures market than gold and silver. Lower liquidity tends to support higher volatility.

The case for higher platinum prices remains compelling in early September 2025. Buying during the current correction, leaving plenty of room to add on further declines, could be optimal.

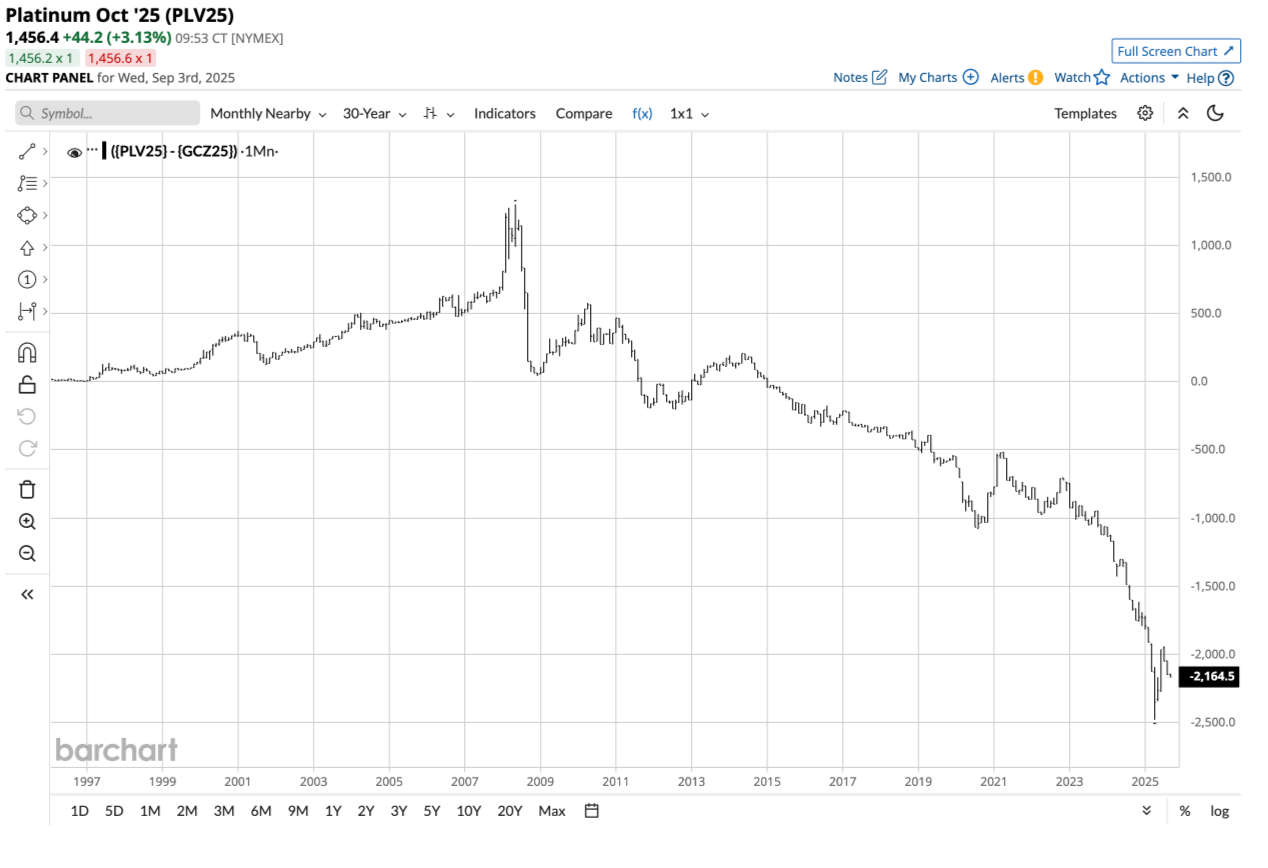

The chart of the platinum-gold spread ({PLV25}-{GCZ25}) highlights that platinum had traded at a premium to gold in the 1990s, reaching an over $1,000 premium in 2008. Since 2015, platinum’s discount to gold has been increasing, reaching nearly $2,500 per ounce at the most recent April 2025 low. The bottom line is that platinum is historically inexpensive compared to gold.

Technical levels to watch in the futures- PPLT is a platinum ETF

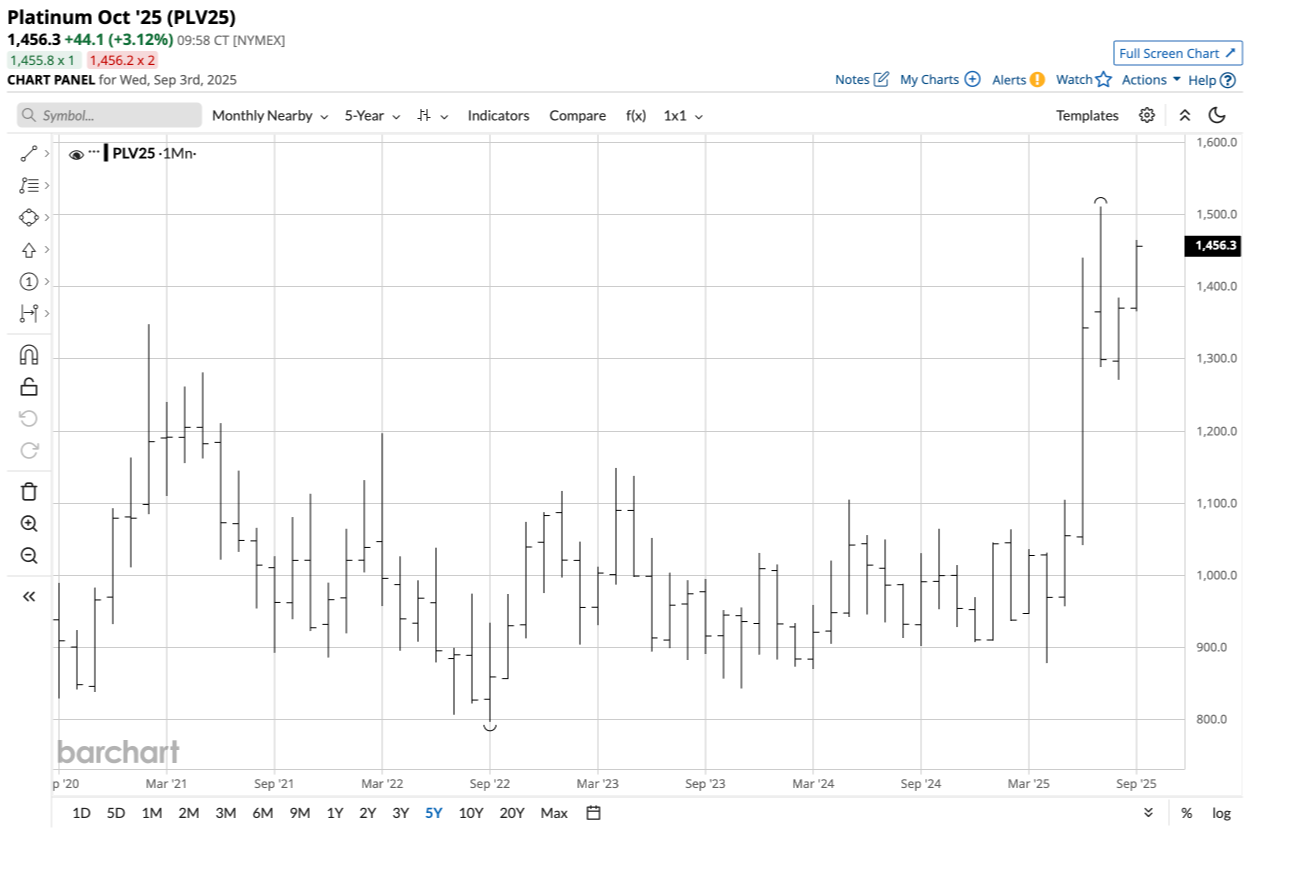

The five-year monthly platinum futures chart highlights the critical technical levels in early September 2025.

As the chart highlights, support for platinum futures is at the March 2022 high of $1,197, the April 2023 high of $1,148.90, and the March 2024 high of $1,105 per ounce, as the prior technical resistance levels have become supports. The current upside target is the July 2025 $1,511.40 per ounce. Above there, platinum traded to a high of $1,523.80 in July 2014, $1,744.50 in February 2023, $1,918.50 in August 2011, and a record high in March 2008 of $2,308.80 per ounce. With gold trading over $1,300 above platinum’s March 2008 record peak, there is substantial upside potential in the platinum futures market.

The most direct route for a risk position in platinum is the physical market for platinum bars and coins. However, physical platinum often involves substantial premiums for purchases and discounts for sales. The futures market has a physical delivery mechanism, but it involves significant leverage with margin requirements. The most liquid platinum ETF, the Aberdeen Physical Platinum product (PPLT) makes a platinum investment available in standard equity accounts.

At $130.52 per share, PPLT had over $1.684 billion in assets under management. PPLT trades an average of 205,941 shares daily and charges a 0.60% management fee. PPLT is a highly liquid ETF product.

Platinum futures rallied 72% from the low on April 7, 2025, to the high on July 21, 2025.

As the chart shows, PPLT rose 61.6% from $82.79 to $133.80 per share from the low of April 7 to its high on July 18. While PPLT does a reasonable job tracking platinum prices, the expense ratio weighs on the performance. However, the management fee covers expenses, including storage and insurance. Moreover, since PPLT only trades during U.S. stock market hours and platinum futures trade around the clock, the ETF can miss highs or lows when the stock market is closed.

Time will tell if platinum catches and surpasses gold on the upside, but there is plenty of room for platinum to narrow the price gap. Platinum remains in a bullish trend in early September 2025, with lots of upside potential at the $1,460 per ounce level.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.