Goldman Sachs Is Betting $1 Billion on This 1 Stock. Should You?

T. Rowe (TROW) shares opened nearly 10% up today after Goldman Sachs (GS) announced plans of investing $1 billion in the Baltimore-headquartered asset management firm.

The two financial services behemoths have partnered on bringing retail investors access to private market products, according to their joint press release on Thursday.

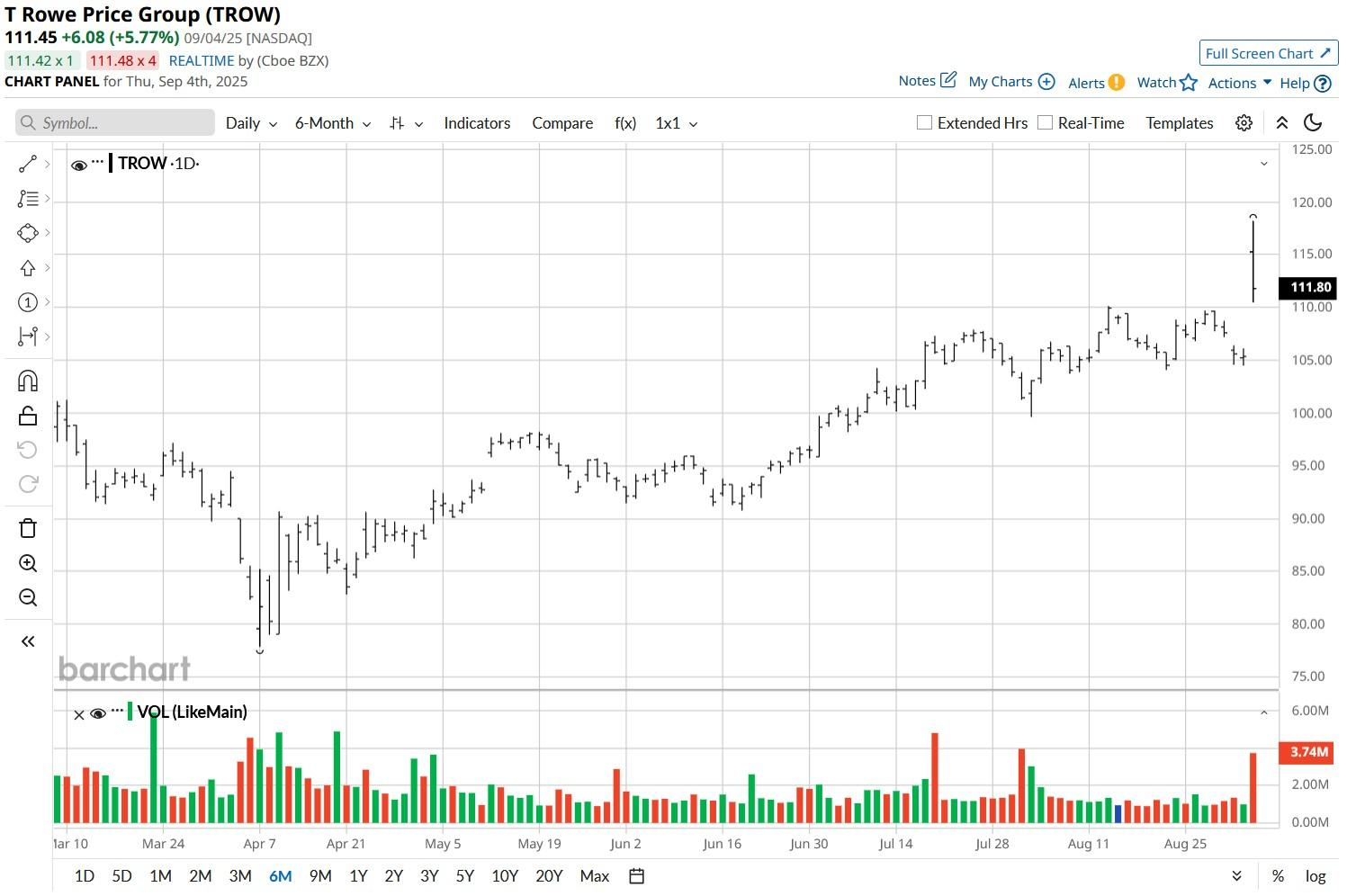

Today’s rally adds to the massive gains T. Rowe stock has already accumulated over the past four months. Versus early April, it’s up nearly 40% at the time of writing.

Significance of Goldman Sachs’ Partnership for TROW Stock

Goldman Sachs’ equity investment is meaningfully positive for TROW stock since it signals strong institutional confidence in the asset manager’s long-term strategy.

The collaboration aims at democratizing access to private market products, an asset class typically reserved for institutions and ultra-wealthy clients.

By tapping into Goldman’s alternative investment expertise, T. Rowe, with its retirement-focused distribution network, is positioned to unlock new revenue streams and deepen client engagement.

For the Nasdaq-listed firm, which has faced asset outflows and competitive pressure, this alliance offers both capital support and strategic relevance, boosting investor sentiment and driving the stock higher.

Why Else Are T. Rowe Shares Worth Owning in 2025

Other than the Goldman Sachs’ partnership, T. Rowe Price is worth owning for the strength of its financials as well.

In its latest reported quarter, the asset manager earned $2.24 on a per-share basis, handily beating the $2.15 a share that analysts had forecast.

Investors should also note that TROW stock is currently trading at a relatively attractive valuation. At the time of writing, it’s going for a forward price-earnings (P/E) ratio of 11.58x only.

In comparison, peers Blackrock (BLK) and Blackstone (BX) have that multiple pegged at roughly 24x and 34x, respectively. Finally, a rather lucrative 4.55% dividend yield makes T. Rowe shares all the more attractive as a long-term holding.

How Wall Street Recommends Playing T. Rowe Stock

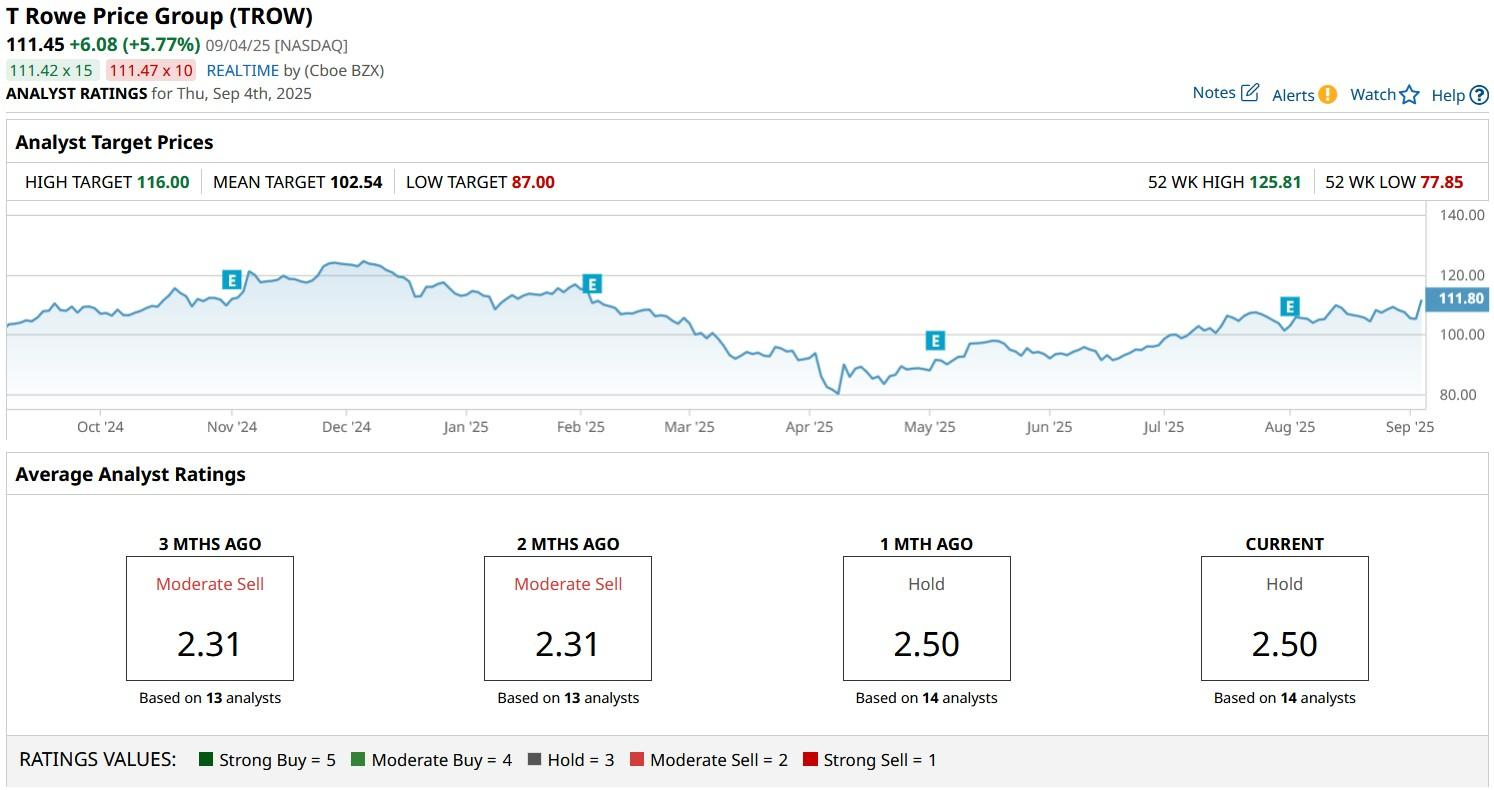

Despite the aforementioned positives, Wall Street analysts remain cautious on T. Rowe stock in 2025.

The consensus rating on TROW shares currently sits at “Hold” only with the mean target of roughly $102 indicating potential downside of some 10% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.