Should You Buy the Post-Earnings Pop in Macy’s Stock?

Macy's (M) began over a century ago as a small dry goods shop in New York and grew into “America’s Department Store,” blending iconic traditions, hundreds of stores, and a strong e-commerce presence. From fashion and beauty to home essentials and holiday traditions, Macy’s has long been part of the nation’s fabric—but the recent years haven’t been easy. The retail giant has battled slowing sales and shifting consumer habits.

This week, the story took an unexpected turn. Macy’s stock jumped over 20% after delivering its first same-store sales growth in three years in Q2. CEO Tony Spring’s ambitious turnaround strategy—shutting 150 underperforming stores, reinvesting in top locations, and pushing premium labels—is finally showing signs of life.

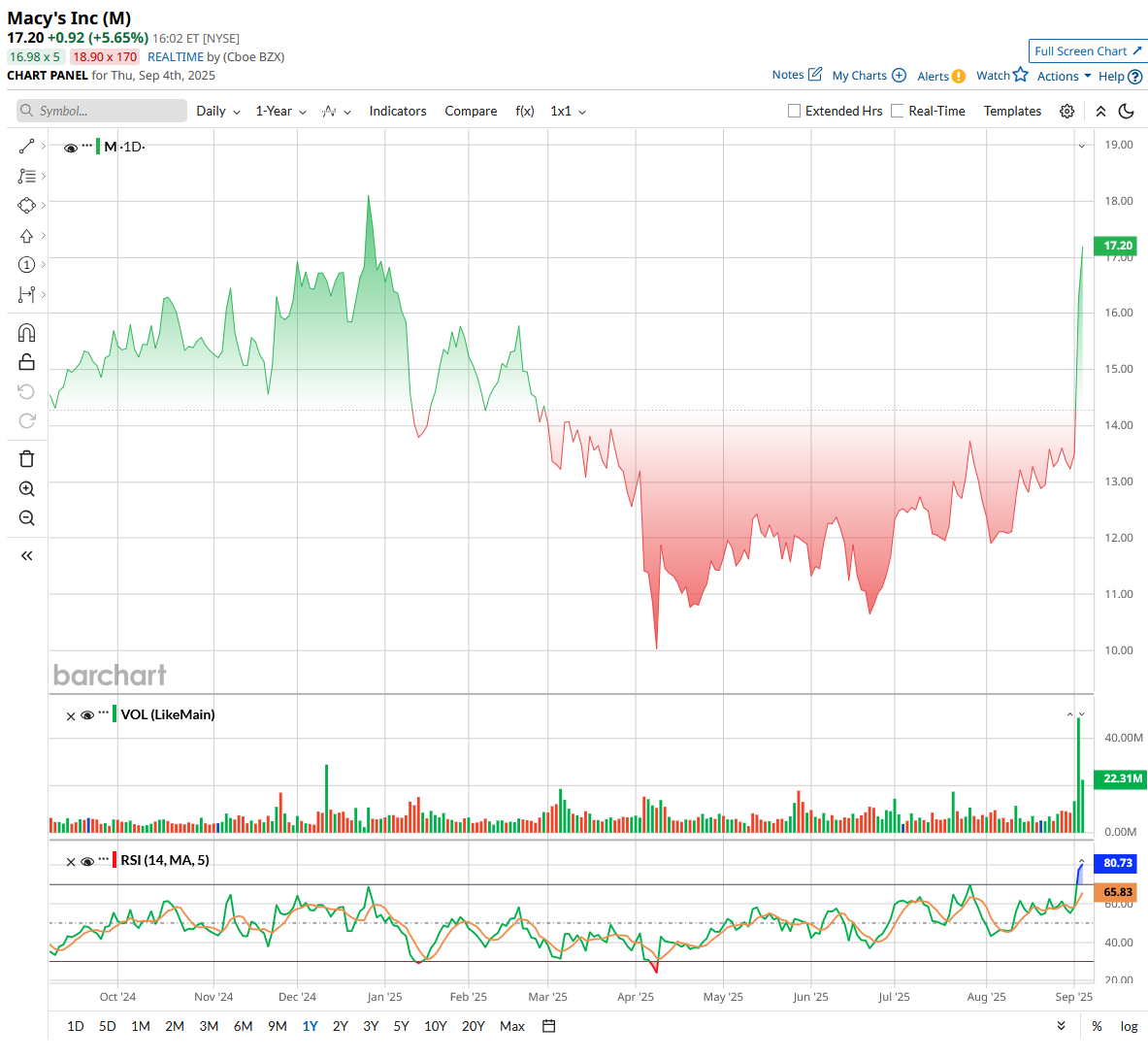

With raised revenue and profit forecasts, Macy’s is signaling confidence even as U.S. holiday spending faces headwinds. With the stock breaking above the 14-3 day raw stochastic at 80% ($15.67) and showing solid bullish momentum, can Macy’s rally hold, or is a pullback looming?

Should investors buy Macy’s post-earnings breakout?

About M Stock

Macy’s, once a humble New York dry goods shop in 1858 and formerly known as Federated Department Stores, has evolved into a retail powerhouse, currently boasting a market capitalization of $3.7 billion. Rebranded in 2007, the company now operates under its flagship Macy’s, alongside Bloomingdale’s and Bluemercury, offering apparel, beauty, home furnishings, and more through an omnichannel ecosystem of stores, websites, and mobile apps.

Expanding beyond U.S. borders, Macy’s has extended its presence into Dubai and Kuwait via licensing agreements. Blending iconic heritage with digital innovation, Macy’s continues to adapt, curating premium market and private-label brands to inspire shoppers while driving growth in a challenging retail landscape.

M stock has experienced significant volatility this year. After peaking at $18.13 last December—the 52-week high—shares have been under $14 since mid-March and bottomed at a 52-week low of $9.76 in April. But Q2 earnings flipped the narrative, triggering a nearly 21% post-earnings surge that sent Macy’s shares soaring. The stock trades above $16, marking a 75% rebound from April’s lows and a 49% gain over the past three months.

Volume spiked to 48.5 million, more than triple the day before the Q2 report, signaling renewed investor appetite. The 14-day RSI has spiked to 80.33, placing the stock firmly in overbought territory, typically a bullish signal but one that often precedes short-term pullbacks as traders lock in gains.

With the stock now eyeing its first key resistance at $17.57 and a stronger ceiling near $18.10, Macy’s could see some consolidation before attempting a breakout. Still, with technical momentum aligning with improving fundamentals, the stock’s recovery trend remains intact.

From a valuation standpoint, Macy’s is trading at just 7.3 times forward earnings and 0.16 times forward sales, both notably below the broader sector median. Historically, Macy’s price-to-sales (P/S) ratio has hovered at slightly higher levels, making the current discount even more striking.

For 21 consecutive years, Macy’s has kept shareholders smiling with consistent dividend payments. On Aug. 22, management declared a $0.1824 per share quarterly payout, set to be paid on Oct. 1, 2025.

That brings the forward annualized dividend to $0.73 per share, a 4.48% yield—quadruple the S&P 500 SPDR’s (SPY) 1.11% yield. With a conservative 15% payout ratio, Macy’s dividend looks not just generous but also sustainable, signaling confidence in its cash flows even amid the shifting tides of retail.

Macy’s Rises After Q2 Earnings Results

Macy’s is back in the headlines, and this time, it’s for all the right reasons. On Sept. 3, the New York-based department store operator posted Q2 earnings results that beat Wall Street’s expectations on both top and bottom lines, surprising skeptics and giving its turnaround story fresh legs.

Adjusted diluted EPS declined 22.6% year-over-year (YoY) to $0.41, while net sales fell 2.5% to $4.8 billion—both surpassing the company’s guidance. Nearly $170 million of the top-line dip came from the 64 store closures last year. Strip that out, and the numbers tell a different tale: comparable sales rose 1.9% annually on an owned-and-licensed basis, marking Macy’s strongest growth in 12 quarters and showing positive comps across all three of its banners—Macy's, Bloomingdale’s, and Bluemercury.

CEO Tony Spring, now in year two of his “Bold New Chapter” strategy, is reshaping Macy’s for the future. The plan is closing 150 underperforming stores and doubling down on the remaining 350 locations, elevating assortments, enhancing service, and leaning into higher-margin premium labels. Already, 125 stores have been “reimagined,” and shoppers are responding. “We’ve shifted from being an operationally led to a customer-led organization,” Spring told analysts, emphasizing a focus on curated assortments and better brand-category calibration.

Financially, Macy’s has tightened its ship. Cash reserves stood at $829 million in Q2, and a series of financing moves cut long-term debt by $340 million, leaving no material maturities until 2030. The company also returned $50 million to shareholders via dividends and repurchased 4 million shares, bringing first-half buybacks to 12.6 million shares worth $151 million. With $1.2 billion still authorized for repurchases, Macy’s continues rewarding investors while fortifying its balance sheet.

Looking ahead, Macy’s lifted its 2025 sales guidance to the $21.15 billion to $21.45 billion range and raised EPS projections to $1.70 to $2.05. The outlook factors in the hit from 2024’s store closures, which shaved about $700 million off annual sales.

Comparable owned-plus-licensed-plus-marketplace sales are now projected to decline 1.5% to 0.5% YoY, improving from the earlier 2% to 0.5% drop. For Macy’s go-forward business, comparable sales are expected to range from a 1.5% dip to flat, versus the prior 2% dip to flat outlook.

While management expects consumers to stay cautious amid tariffs and a competitive retail landscape, Macy’s sees strength in its diversified portfolio and omnichannel reach, spanning from off-price to luxury. With improving comparable sales, a leaner store footprint, and a healthier balance sheet, the retailer is proving its turnaround isn’t just a headline—it is showing up in the numbers.

Analysts are a bit more cautious despite Macy’s upbeat guidance. They expect EPS to slip by 29.9% YoY to $1.85 per share in fiscal 2025, reflecting softer margins and the impact of store closures. The pressure does not stop there, as forecasts project another 2.2% annual dip to roughly $1.81 per share in fiscal 2026.

What Do Analysts Expect for M Stock?

Macy’s Q2 report lit up Wall Street with mixed reactions. EMarketer’s Suzy Davidkhanian called Macy’s decision to raise forecasts a “bold move,” given today’s overcrowded retail landscape and tighter consumer budgets. But Dana Telsey from Telsey Advisory Group was not fully convinced, keeping a “Market Perform” rating. She warned that while trimming store counts could help long-term profitability, sales visibility remains blurry with macro pressures, traffic slowdowns, tariffs, and relentless competition.

Jefferies, meanwhile, went bullish and hiked its price target from $14.50 to $18.50 and reaffirmed a “Buy” rating. Analysts there see Macy’s shoppers as “choiceful but resilient,” noting July’s strength and better-than-feared trends. Still, Jefferies flagged risks tied to demand elasticity and a possible economic slowdown but believes Macy’s “self-help initiatives” offer upside potential.

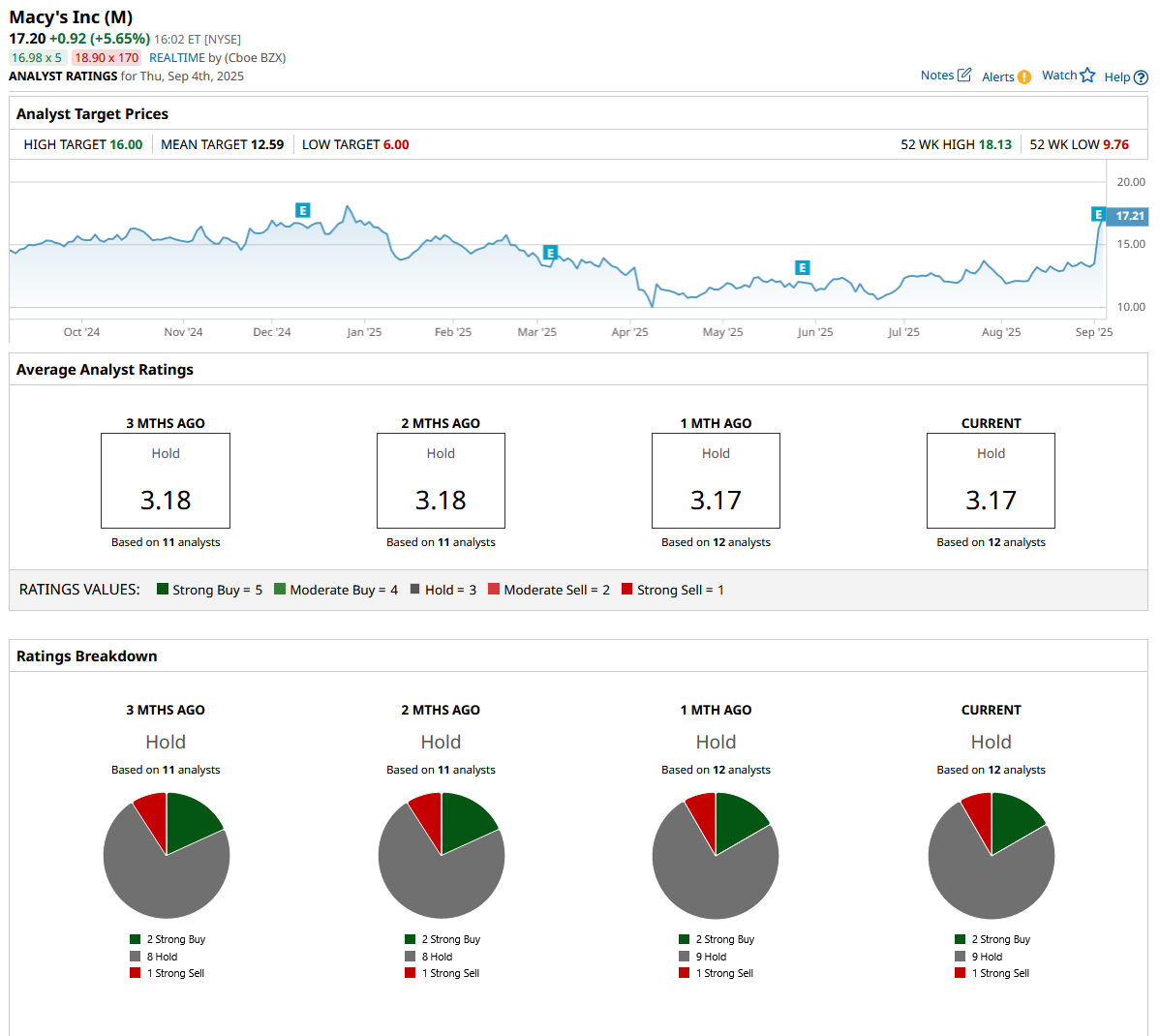

Overall, analysts are cautious, with M stock currently rated a consensus “Hold.” Of the 12 analysts covering the stock, two suggest a “Strong Buy,” nine recommend a “Hold,” and the remaining one has a “Strong Sell.”

While Macy’s stock’s recent rally pushed it above the mean price target of $12.59, Jefferies’ Street-high target of $18.50 suggests the stock could rally as much as 13.6%.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.