Is Devon Energy Stock Underperforming the Nasdaq?

With a market cap of $22.1 billion, Devon Energy Corporation (DVN) is a leading independent U.S. oil and natural gas producer with operations across top shale basins, including the Delaware, Eagle Ford, Anadarko, Williston, and Powder River. The company’s core operations are concentrated in key onshore basins, including the Delaware Basin, Eagle Ford, Anadarko, Williston, and Powder River.

Companies valued at $10 billion or more are generally considered "large-cap" stocks, and Devon Energy fits this criterion perfectly. The company holds over 2.1 billion BOE in proved reserves. It emphasizes financial discipline, targeting strong free cash flow through efficient capital spending, a fixed-plus-variable dividend policy, and share buybacks.

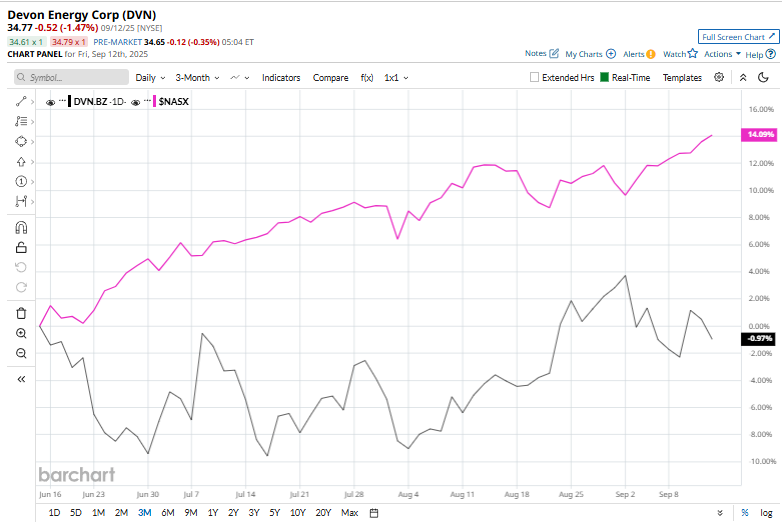

Shares of the energy behemoth pulled back 19.7% from its 52-week high of $43.29. Devon Energy’s shares have soared 1.3% over the past three months, underperforming the broader Nasdaq Composite’s ($NASX) 12.6% rise over the same time frame.

In the longer term, shares of the oil and gas exploration company have decreased 13.1% over the past 52 weeks, lagging behind $NASX’s 26% over the same time frame. Moreover, DVN stock is up 6.2% on a YTD basis, compared to $NASX’s 14.7% rise.

Despite recent fluctuations, the stock has been trading above its 50-day and 200-day moving averages since the last month.

On Sept. 11, Devon Energy shares slipped more than 1% as falling WTI crude oil prices, down nearly 2%, weighed on energy producers and service providers.

In comparison, rival ConocoPhillips (COP) stock has dropped 10.2% over the past 52 weeks and 6.8% on a YTD basis, surpassing DVN’s performance over the same time frames.

Despite the stock’s weak performance over the past year, analysts remain moderately optimistic on DVN. The stock has a consensus rating of “Moderate Buy” from the 27 analysts covering it, and the mean price target of $45.08 implies an upside potential of 29.7% from the current market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.